Ensuring Your Jewels Are Properly Protected: A Comprehensive Guide to Jewelry Valuation for Insurance Purposes

Related Articles: Ensuring Your Jewels Are Properly Protected: A Comprehensive Guide to Jewelry Valuation for Insurance Purposes

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Ensuring Your Jewels Are Properly Protected: A Comprehensive Guide to Jewelry Valuation for Insurance Purposes. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Ensuring Your Jewels Are Properly Protected: A Comprehensive Guide to Jewelry Valuation for Insurance Purposes

Jewelry, with its intrinsic beauty and often significant monetary value, demands careful consideration when it comes to insurance. A well-executed jewelry valuation is not merely a formality; it’s the cornerstone of ensuring adequate coverage in the event of loss, damage, or theft. This comprehensive guide will delve into the intricacies of valuing jewelry for insurance purposes, empowering you to make informed decisions that safeguard your precious possessions.

The Importance of a Professional Appraisal

While it may seem tempting to attempt a DIY valuation, relying on professional expertise is paramount. Jewelry appraisals conducted by qualified gemologists or appraisers offer several crucial advantages:

- Accuracy and Objectivity: Appraisers possess the specialized knowledge and tools to accurately assess the intrinsic value of your jewelry. They consider factors like gemstone quality, metal purity, craftsmanship, and market trends, ensuring a fair and unbiased valuation.

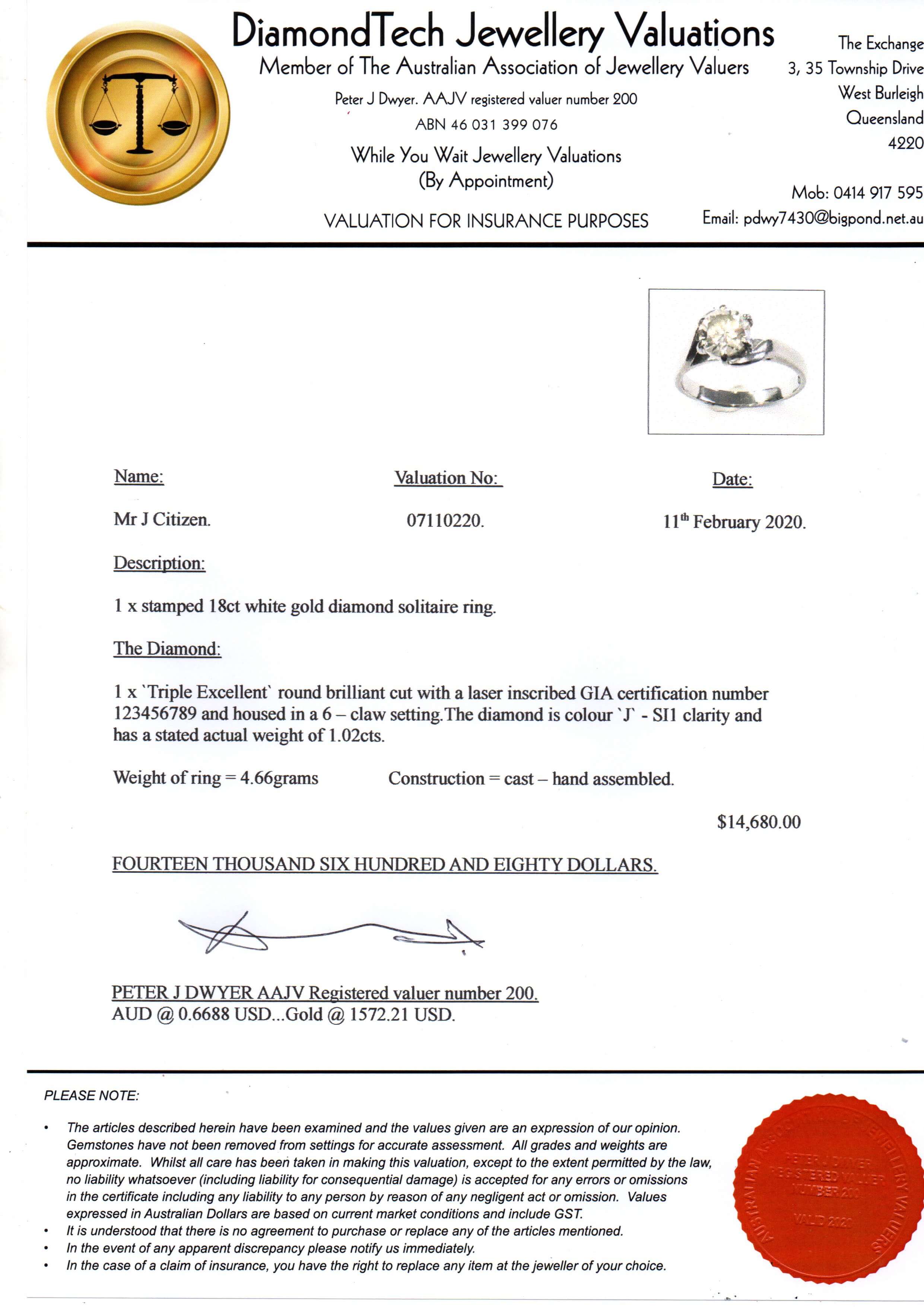

- Legal Documentation: A professional appraisal provides a legally binding document, crucial for insurance claims. It serves as irrefutable evidence of the value of your jewelry in the event of a claim.

- Peace of Mind: Knowing your jewelry is accurately valued provides peace of mind, knowing you are adequately protected against potential financial losses.

Understanding the Valuation Process

A professional jewelry appraisal typically involves the following steps:

- Initial Consultation: The appraiser will discuss the purpose of the appraisal, the history of the jewelry, and any specific requirements of your insurance provider.

- Examination and Documentation: The appraiser meticulously examines each piece of jewelry, recording details like gemstone type, carat weight, clarity, color, cut, metal type, and hallmark. Photographs and detailed descriptions are also taken.

-

Valuation Methods: The appraiser employs different valuation methods depending on the type of jewelry and its purpose. Common methods include:

- Replacement Cost: This method determines the cost of replacing the jewelry with an identical or comparable piece in the current market.

- Retail Value: This method considers the price at which a similar piece could be purchased from a reputable retailer.

- Agreed Value: This method is often used for antique or unique jewelry, where a specific value is agreed upon by the insured and the insurer.

- Report Generation: The appraiser compiles a comprehensive appraisal report, outlining the details of the jewelry, the valuation methods used, and the final assessed value.

Key Factors Influencing Jewelry Value

Several factors contribute to the overall value of a piece of jewelry, influencing its insurance coverage:

-

Gemstones: The "Four Cs" – Cut, Clarity, Color, and Carat Weight – are the primary determinants of a gemstone’s value.

- Cut: Refers to the shape and facets of a gemstone, influencing its brilliance and fire.

- Clarity: Represents the absence of inclusions (internal flaws) and blemishes (external flaws).

- Color: The intensity, hue, and saturation of a gemstone’s color.

- Carat Weight: The weight of a gemstone, measured in carats.

- Metal: The type and purity of the metal used in the jewelry (e.g., gold, platinum, silver) significantly influence its value.

- Craftsmanship: The skill and artistry involved in the design and construction of the jewelry. Unique or intricate designs often command higher values.

- Brand and Origin: Renowned jewelers or specific geographical origins can enhance the value of a piece.

- Historical Significance: Jewelry with a documented past or association with notable figures can carry substantial historical value.

- Condition: The overall condition of the jewelry, including wear and tear, repairs, and authenticity, affects its value.

Tips for Valuing Your Jewelry for Insurance

- Choose a Qualified Appraiser: Select an appraiser with expertise in jewelry valuation and relevant certifications (e.g., Gemological Institute of America (GIA), American Society of Appraisers (ASA)).

- Document the History: Gather any available information about the jewelry’s origin, purchase date, and any previous appraisals.

- Provide Detailed Information: Be prepared to share all relevant details about the jewelry, including any inscriptions, hallmarks, or identifying features.

- Compare Appraisals: Obtain appraisals from multiple reputable appraisers to ensure consistency in the valuations.

- Update Regularly: Jewelry values fluctuate due to market trends and changes in gemstone prices. It’s recommended to re-appraise your jewelry every 3-5 years.

FAQs about Jewelry Valuation for Insurance

Q: Do I need to have my jewelry appraised for insurance purposes?

A: While not always mandatory, it is highly recommended. An appraisal provides concrete evidence of your jewelry’s value, facilitating a smooth claims process in the event of loss or damage.

Q: How often should I re-appraise my jewelry?

A: It is generally recommended to re-appraise your jewelry every 3-5 years, as values can fluctuate due to market trends and gemstone price changes.

Q: What information should I provide to the appraiser?

A: Provide any available documentation, including purchase receipts, previous appraisals, certificates of authenticity, and any relevant information about the jewelry’s history.

Q: How much does a jewelry appraisal cost?

A: The cost of a jewelry appraisal varies depending on the appraiser’s fees, the complexity of the appraisal, and the number of pieces being appraised.

Q: What should I do if I disagree with the appraiser’s valuation?

A: If you have concerns about the appraisal, you can always seek a second opinion from another qualified appraiser.

Conclusion

Valuing jewelry for insurance purposes is a crucial step in safeguarding your precious possessions. A professional appraisal provides accurate, objective, and legally binding documentation of your jewelry’s value, ensuring adequate coverage in the event of loss, damage, or theft. By understanding the valuation process, key factors influencing value, and following the tips provided, you can make informed decisions that protect your jewelry investments and provide peace of mind. Remember, a well-executed appraisal is not just a document; it’s a testament to your commitment to preserving your treasured jewels.

Closure

Thus, we hope this article has provided valuable insights into Ensuring Your Jewels Are Properly Protected: A Comprehensive Guide to Jewelry Valuation for Insurance Purposes. We hope you find this article informative and beneficial. See you in our next article!