Navigating India’s Customs Regulations: A Guide to Gold Jewelry Limits

Related Articles: Navigating India’s Customs Regulations: A Guide to Gold Jewelry Limits

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating India’s Customs Regulations: A Guide to Gold Jewelry Limits. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating India’s Customs Regulations: A Guide to Gold Jewelry Limits

India, with its rich cultural heritage and appreciation for gold jewelry, has established specific regulations regarding the import and export of gold. Understanding these regulations is crucial for travelers, returning residents, and those involved in international trade. This article provides a comprehensive guide to the current gold jewelry limits imposed by Indian Customs, aiming to clarify the regulations and empower individuals to comply effectively.

Understanding the Basics: The Rationale Behind Gold Restrictions

India’s customs policies regarding gold are driven by several key factors:

- Economic Stability: Gold is a valuable commodity, and its uncontrolled import can impact the country’s currency exchange rate and inflation.

- Preventing Smuggling: Strict regulations help curb illegal gold smuggling activities, which can have detrimental consequences for the economy and national security.

- Controlling Gold Demand: By limiting gold imports, the government aims to regulate the demand for gold, which can fluctuate significantly based on global market prices and cultural trends.

- Promoting Domestic Production: Encouraging domestic gold production and recycling helps reduce reliance on imports and contributes to a more self-sufficient economy.

Current Gold Jewelry Limits for Passengers:

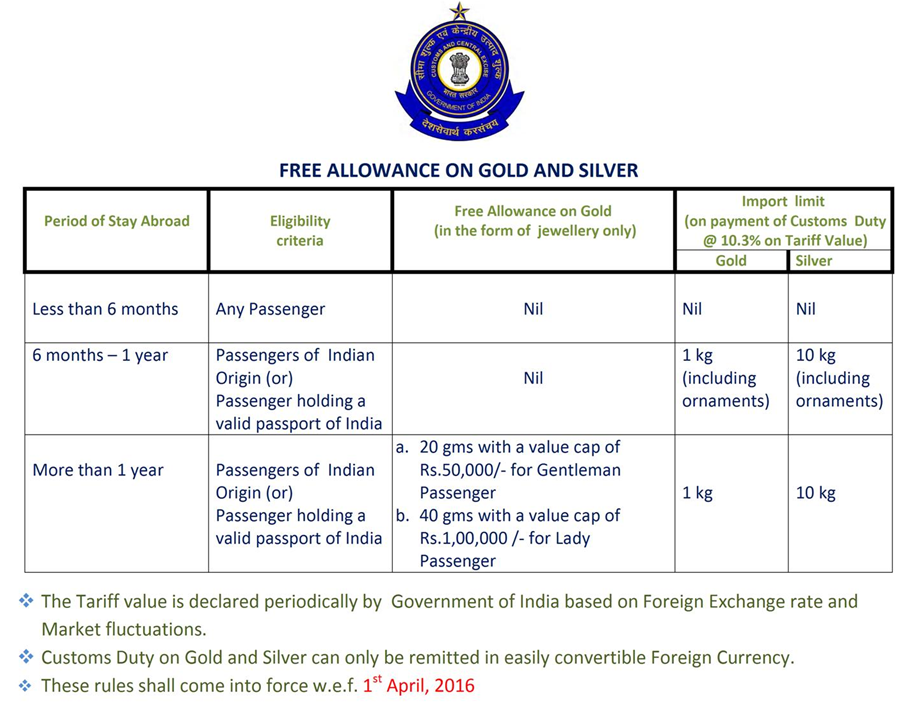

The Indian Customs Department has established specific limits for gold jewelry that passengers can bring into the country without incurring duty charges. These limits are based on the passenger’s residency status:

1. Indian Citizens Returning to India:

- Up to 100 grams of gold jewelry: This limit applies to Indian citizens returning to India after traveling abroad. The jewelry must be for personal use and accompanied by appropriate documentation, such as receipts or invoices.

- No limit for gold jewelry brought back by Indian citizens who have been residing abroad for at least one year: This exemption applies to individuals who have established permanent residency abroad and are returning to India. They are allowed to bring back any amount of gold jewelry without paying duty, provided they meet the necessary residency requirements.

2. Foreign Nationals Visiting India:

- Up to 10 grams of gold jewelry: This limit applies to foreign nationals entering India for tourism or business purposes. The jewelry must be for personal use and declared to customs officials upon arrival.

Important Considerations:

- Declaration is Mandatory: All travelers are required to declare any gold jewelry they are carrying, regardless of the quantity, upon arrival in India. Failure to do so can lead to fines and penalties.

- Documentation is Crucial: Travelers must present valid purchase receipts or invoices for the gold jewelry they are carrying to support their declaration.

- Jewelry Must be for Personal Use: The gold jewelry must be for personal use and not intended for commercial purposes.

- Duty Charges: Exceeding the permitted limits for gold jewelry will result in duty charges. The duty rate varies based on the type of gold and its purity.

Gold Jewelry Limits for Commercial Import:

The import of gold jewelry for commercial purposes is subject to stricter regulations and requires a license from the Reserve Bank of India (RBI). The process involves obtaining an import permit, providing detailed documentation, and complying with various customs formalities.

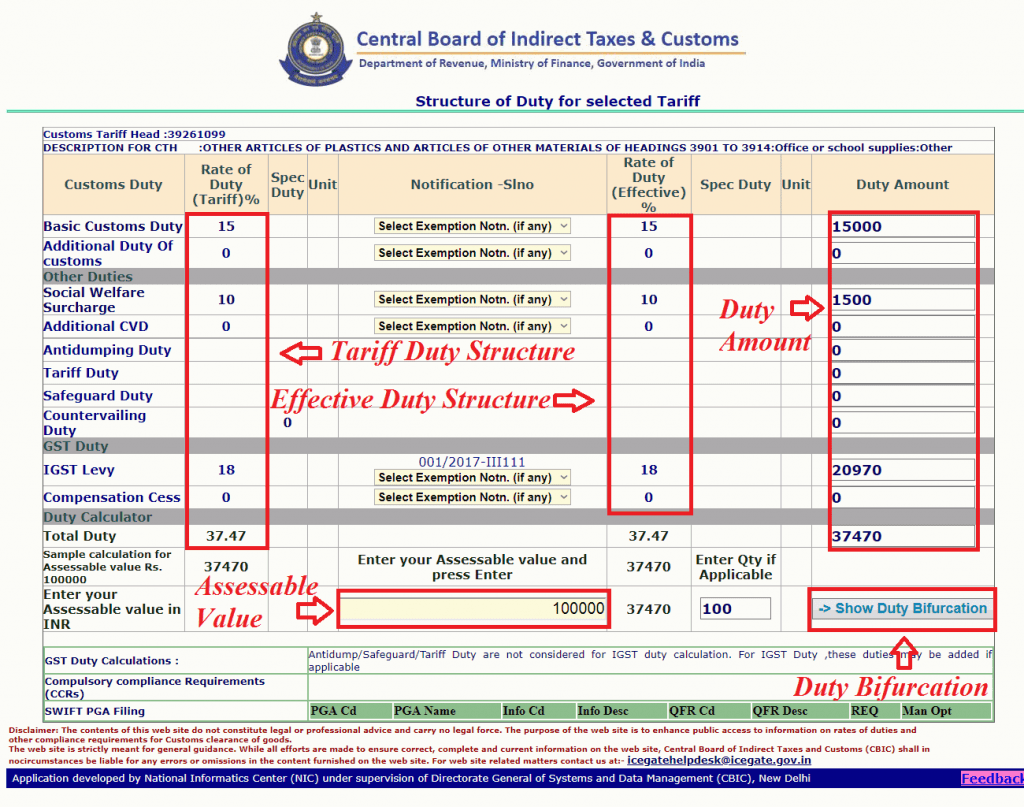

Understanding Duty Charges:

If the gold jewelry brought into India exceeds the allowed limit, duty charges will be levied. The duty rate varies based on the type of gold and its purity. Typically, the duty rate is around 10% of the gold’s value.

FAQs on India’s Gold Jewelry Limits:

1. Can I bring gold coins or bars into India?

Gold coins and bars are considered bullion and are subject to different regulations. Bringing in gold bullion requires specific permits and documentation.

2. What happens if I declare my gold jewelry but it exceeds the limit?

You will be required to pay duty on the excess amount of gold jewelry.

3. Can I gift gold jewelry to someone in India?

Gifting gold jewelry to someone in India is permitted, but the recipient will be subject to the same gold jewelry limits and duty charges as outlined above.

4. What if I am traveling through India and not entering the country?

If you are transiting through India, you are not subject to the gold jewelry limits. However, you may still be required to declare any gold jewelry you are carrying.

5. What are the penalties for smuggling gold into India?

Smuggling gold into India is a serious offense and can result in hefty fines, imprisonment, and confiscation of the gold.

Tips for Complying with India’s Gold Jewelry Regulations:

- Plan Ahead: Before traveling to India, research and understand the current gold jewelry limits and regulations.

- Declare Accurately: Declare all gold jewelry you are carrying to customs officials upon arrival.

- Keep Documentation: Maintain proper receipts and invoices for your gold jewelry.

- Consult with an Expert: If you are unsure about the regulations or have concerns, consult a customs broker or legal professional.

Conclusion:

Navigating India’s gold jewelry regulations requires a clear understanding of the limits, duty charges, and documentation requirements. By adhering to these regulations, travelers and importers can ensure a smooth and compliant experience. Staying informed and taking the necessary steps to comply with these regulations is essential for a hassle-free journey and a positive experience in India.

/GettyImages-200568225-001-58ee43895f9b582c4daf77c7.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating India’s Customs Regulations: A Guide to Gold Jewelry Limits. We thank you for taking the time to read this article. See you in our next article!