Navigating the E-Way Bill Landscape for Jewellery: A Comprehensive Guide

Related Articles: Navigating the E-Way Bill Landscape for Jewellery: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the E-Way Bill Landscape for Jewellery: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the E-Way Bill Landscape for Jewellery: A Comprehensive Guide

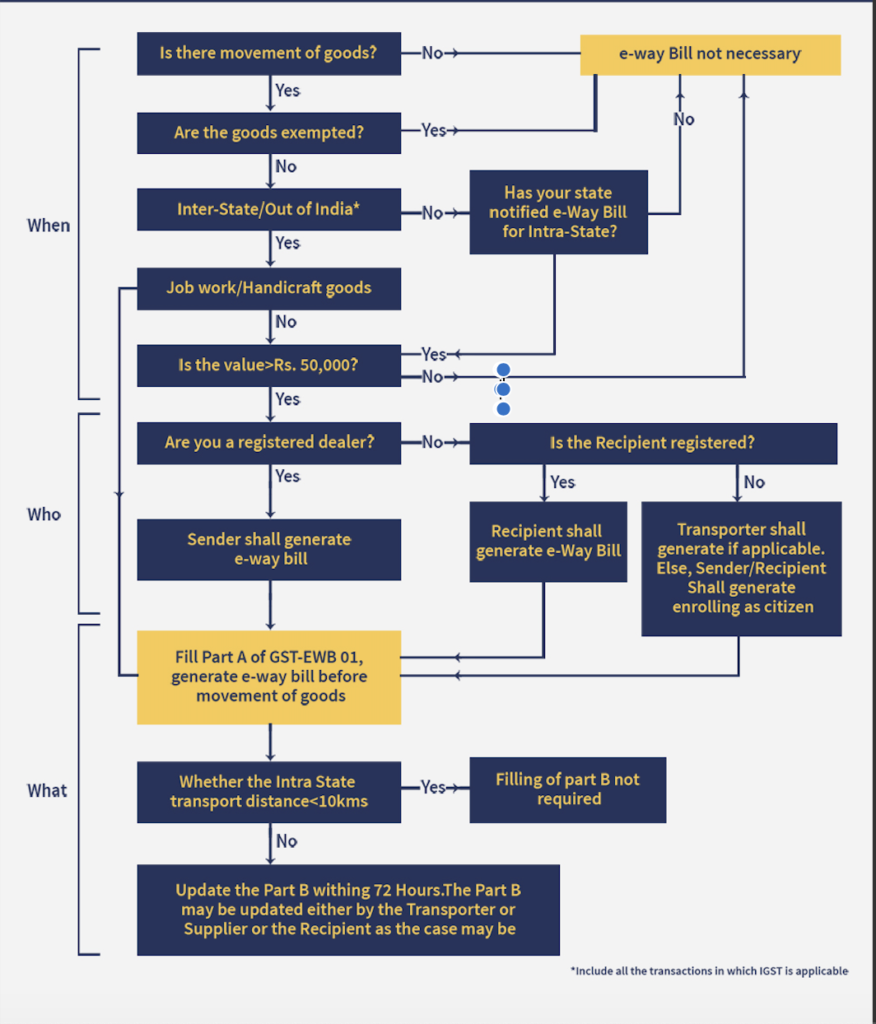

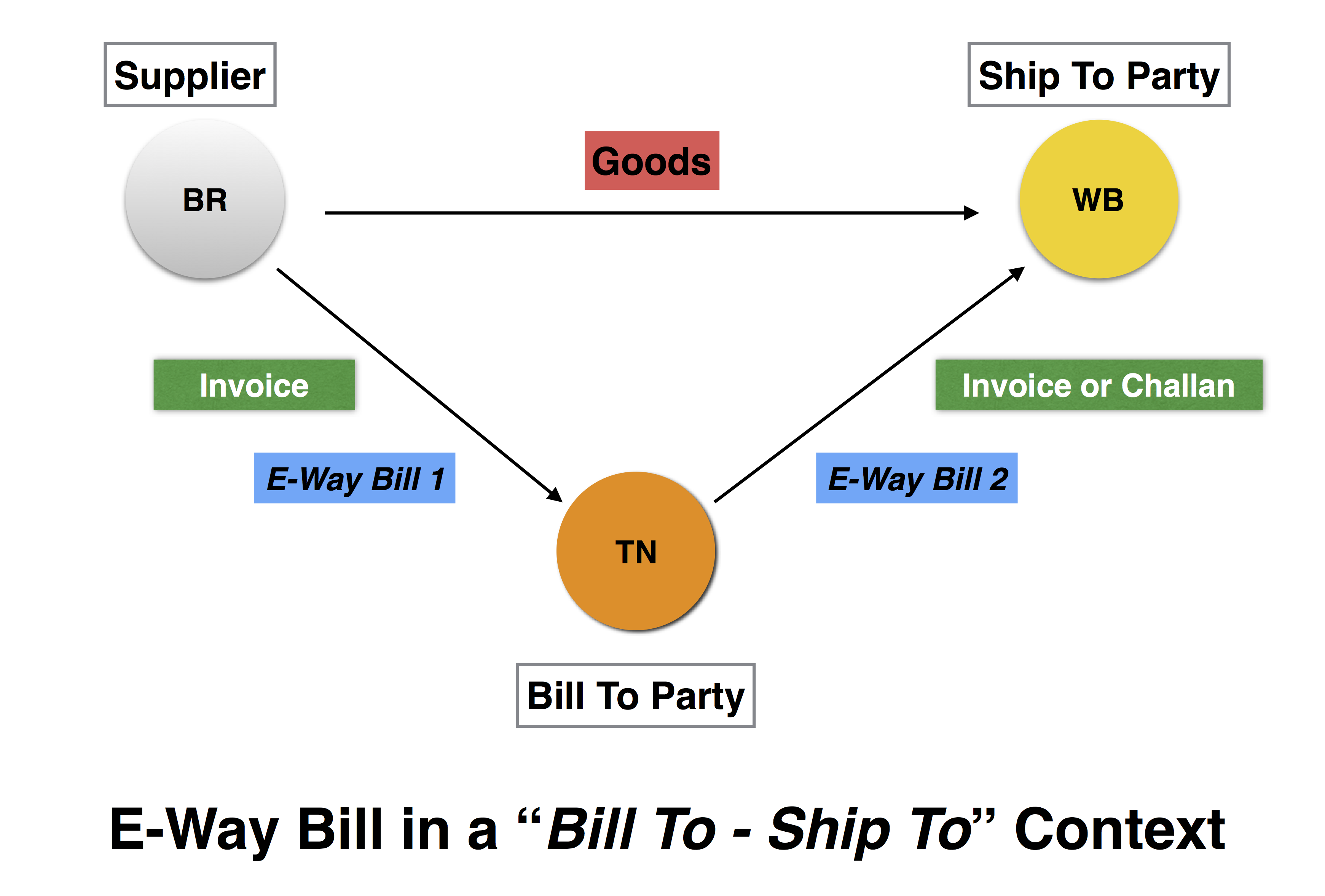

The Indian Goods and Services Tax (GST) regime, implemented in 2017, introduced the e-way bill system to streamline the movement of goods across state borders. This digital document serves as a crucial link in the supply chain, enabling authorities to track the movement of goods and ensure compliance with tax regulations. While the e-way bill system applies to a wide range of goods, its application to jewellery has often raised questions and generated confusion. This article aims to provide a comprehensive understanding of the e-way bill requirements for jewellery, addressing key aspects like applicability, exemptions, and practical implications.

Understanding E-Way Bill Applicability: A Key for Jewellery Businesses

The e-way bill requirement for jewellery hinges on the specific type of jewellery being transported and the value of the consignment. Here’s a breakdown:

-

Gold and Silver Jewellery: Gold and silver jewellery, including ornaments, are subject to e-way bill requirements when their value exceeds INR 50,000. This threshold applies to both inter-state and intra-state movements.

-

Other Precious Metal Jewellery: Jewellery made from precious metals other than gold and silver, such as platinum, are subject to the e-way bill requirement regardless of their value. This applies to both inter-state and intra-state movements.

-

Semi-Precious and Imitation Jewellery: Jewellery made from semi-precious stones or imitation materials is generally exempt from e-way bill requirements, regardless of value. However, it is essential to check the specific classification of the jewellery to confirm exemption.

Exemptions and Special Considerations for Jewellery Businesses:

While the general rule dictates the e-way bill requirement based on value and material, certain exemptions and special considerations apply to jewellery businesses:

-

Jewellery Shipments Within the Same State: In many cases, intra-state movements of jewellery, even those exceeding the INR 50,000 threshold for gold and silver, may be exempt from e-way bill requirements. However, it is essential to consult the specific rules and guidelines of the respective state to confirm this exemption.

-

Jewellery Shipments for Repairs or Manufacturing: Jewellery being transported for repair or manufacturing purposes may be exempt from e-way bill requirements. However, specific documentation, such as repair orders or manufacturing contracts, may be required to substantiate the exemption.

-

Jewellery Shipments by Registered Jewellery Dealers: Registered jewellery dealers may be subject to different e-way bill requirements. It is crucial to consult the specific rules and regulations applicable to registered dealers to ensure compliance.

Benefits of Complying with E-Way Bill Requirements for Jewellery:

The e-way bill system offers numerous benefits for jewellery businesses, including:

-

Streamlined Movement of Goods: The e-way bill system facilitates the seamless movement of jewellery across state borders, minimizing delays and ensuring efficient transportation.

-

Enhanced Transparency and Traceability: The digital nature of the e-way bill system provides a transparent and traceable record of the movement of jewellery, enhancing accountability and preventing illegal activities.

-

Reduced Risk of Tax Penalties: By adhering to e-way bill requirements, jewellery businesses can significantly reduce the risk of tax penalties and legal complications.

-

Improved Business Reputation: Compliance with e-way bill regulations demonstrates a commitment to transparency and legal practices, enhancing the reputation of jewellery businesses.

Practical Tips for Jewellery Businesses:

To ensure smooth compliance with e-way bill requirements, jewellery businesses can implement the following practical tips:

-

Maintain Accurate Records: Accurate record-keeping is essential for generating e-way bills and maintaining compliance. Businesses should maintain detailed records of all jewellery transactions, including purchase invoices, sales receipts, and transportation details.

-

Utilize E-Way Bill Generation Platforms: Several online platforms and software solutions are available to assist businesses in generating e-way bills efficiently and accurately. Utilize these platforms to streamline the process and minimize errors.

-

Stay Updated on Latest Regulations: The GST regime is subject to periodic updates and amendments. Jewellery businesses should stay informed about the latest e-way bill regulations to ensure compliance.

-

Consult with Tax Professionals: For complex situations or specific queries regarding e-way bill requirements, it is advisable to consult with experienced tax professionals who can provide guidance and ensure compliance.

Frequently Asked Questions (FAQs) about E-Way Bill Applicability for Jewellery:

1. What is the minimum value of jewellery that requires an e-way bill?

For gold and silver jewellery, the minimum value for e-way bill applicability is INR 50,000. For other precious metals, the requirement applies regardless of value.

2. Is an e-way bill required for intra-state movements of jewellery?

While intra-state movements of jewellery exceeding the INR 50,000 threshold for gold and silver may require an e-way bill, specific state regulations may exempt certain movements.

3. What documents are required to generate an e-way bill for jewellery?

Required documents typically include the invoice, transporter details, and GSTIN of the sender and receiver.

4. What happens if I fail to generate an e-way bill for jewellery?

Failure to generate an e-way bill when required can result in penalties and legal complications, including fines and seizure of goods.

5. Can I generate an e-way bill manually or only through online platforms?

While manual generation is possible, utilizing online platforms is recommended for efficiency and accuracy.

Conclusion:

The e-way bill system is a crucial aspect of the GST regime, ensuring transparency and compliance in the movement of goods across state borders. While the system can seem complex, understanding its applicability to jewellery is essential for businesses to operate smoothly and avoid potential legal repercussions. By adhering to the guidelines, maintaining accurate records, and utilizing available resources, jewellery businesses can navigate the e-way bill landscape effectively and ensure compliance with tax regulations. Remember, staying informed and proactive is key to navigating the evolving landscape of GST and e-way bill requirements.

Closure

Thus, we hope this article has provided valuable insights into Navigating the E-Way Bill Landscape for Jewellery: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!