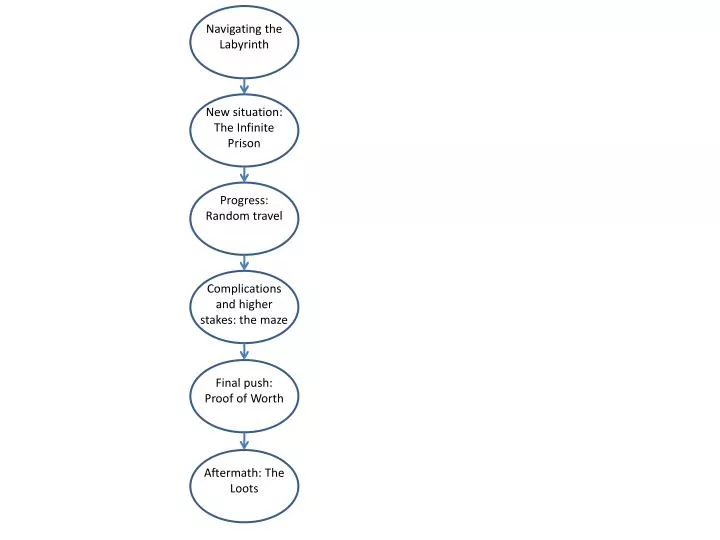

Navigating the Labyrinth: A Comprehensive Guide to HS Codes for Jewellery Items

Related Articles: Navigating the Labyrinth: A Comprehensive Guide to HS Codes for Jewellery Items

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Labyrinth: A Comprehensive Guide to HS Codes for Jewellery Items. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Labyrinth: A Comprehensive Guide to HS Codes for Jewellery Items

The global trade in jewellery, a delicate dance of artistry and commerce, requires a standardized language to facilitate smooth transactions. This language, in the form of Harmonized System (HS) codes, acts as a universal identifier for different types of jewellery, ensuring clarity and consistency in customs declarations, import/export procedures, and trade statistics. Understanding these codes is crucial for businesses operating in the jewellery sector, enabling them to navigate the complexities of international trade with precision.

Deciphering the Code: Structure and Significance

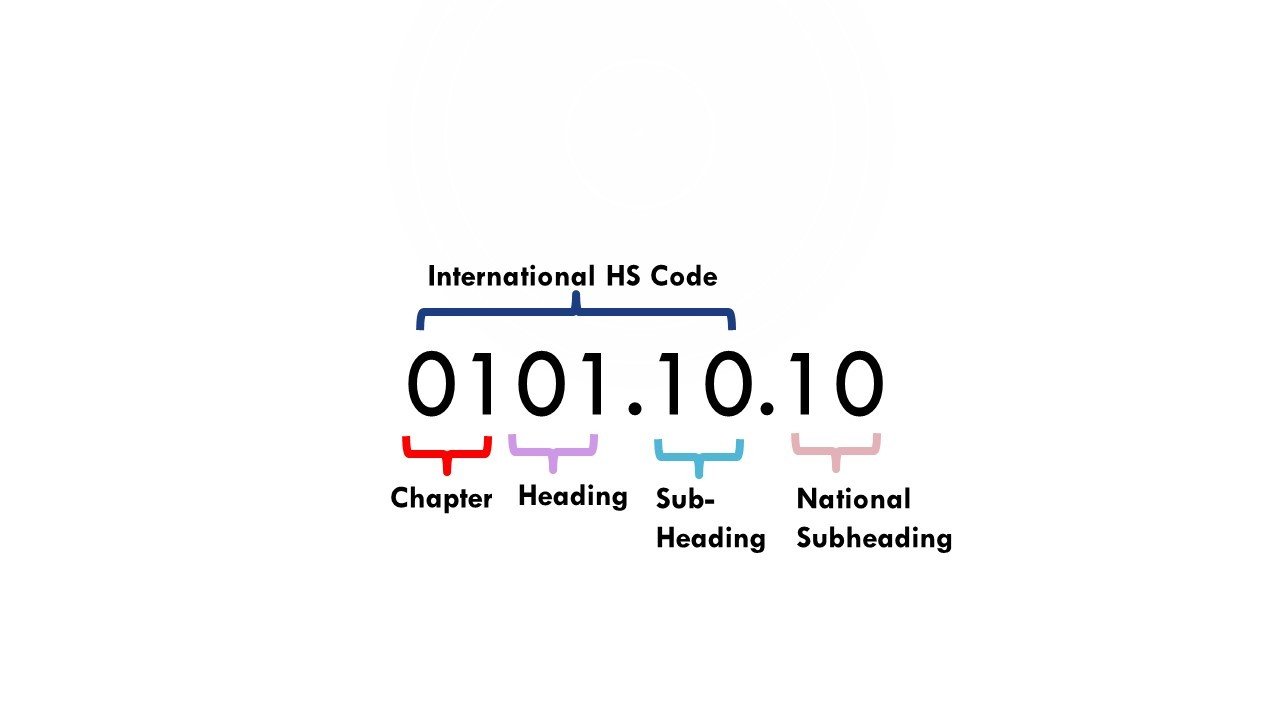

HS codes are a hierarchical system of six-digit numbers, with each digit representing a specific category of goods. The first two digits denote the "heading," which broadly classifies the item. The next two digits represent the "subheading," providing a more specific classification. The final two digits, known as the "tariff code," offer the most detailed description of the item.

For jewellery items, the HS code generally falls under Chapter 71 of the Harmonized System, which encompasses "Pearls, precious and semi-precious stones, precious metals, and articles thereof; imitation jewellery." This chapter is further divided into various headings and subheadings, each representing a specific type of jewellery item.

A Glimpse into the World of Jewellery HS Codes

Let’s delve deeper into some of the key HS codes used for different types of jewellery items:

- 7113.11.00: Gold jewellery – This code encompasses all jewellery items crafted from gold, including rings, necklaces, bracelets, earrings, and pendants.

- 7113.19.00: Silver jewellery – Similarly, this code covers all jewellery items made from silver, encompassing a wide range of styles and designs.

- 7113.20.00: Platinum jewellery – This code specifically designates jewellery items crafted from platinum, a precious metal known for its durability and luster.

- 7114.11.00: Jewellery of precious metal set with precious stones – This code covers jewellery items crafted from precious metals like gold, silver, or platinum, and adorned with precious stones such as diamonds, rubies, sapphires, and emeralds.

- 7114.19.00: Jewellery of precious metal set with semi-precious stones – This code encompasses jewellery items made from precious metals and set with semi-precious stones like amethyst, garnet, topaz, and turquoise.

- 7114.20.00: Jewellery of precious metal set with imitation stones – This code covers jewellery items made from precious metals and adorned with imitation stones like cubic zirconia or glass.

- 7115.10.00: Imitation jewellery of base metal – This code classifies jewellery items crafted from base metals like copper, brass, or nickel, and often set with imitation stones.

- 7115.20.00: Imitation jewellery of plastics – This code covers jewellery items made from plastics, often incorporating imitation stones or other decorative elements.

- 7116.90.00: Other jewellery – This code encompasses all other types of jewellery not specifically covered by the above codes, including items crafted from materials like wood, leather, or bone.

The Importance of HS Codes in the Jewellery Industry

The use of HS codes in the jewellery industry offers a multitude of benefits:

- Streamlined Customs Procedures: HS codes enable customs officials to quickly and accurately identify the nature of imported or exported jewellery items, streamlining customs clearance procedures and minimizing delays.

- Accurate Trade Statistics: HS codes provide a standardized framework for collecting and analyzing trade data, enabling governments and industry stakeholders to gain valuable insights into global jewellery trade patterns and trends.

- Pricing and Duty Calculation: HS codes play a crucial role in determining the applicable import duties and taxes on jewellery items, ensuring transparency and fairness in international trade.

- Product Classification and Standardization: HS codes provide a clear and consistent system for classifying different types of jewellery items, facilitating communication and understanding between buyers, sellers, and industry professionals.

- Market Research and Analysis: HS codes provide a valuable tool for market research and analysis, enabling businesses to identify key competitors, analyze market trends, and make informed strategic decisions.

Frequently Asked Questions (FAQs) Regarding HS Codes for Jewellery Items

Q: What are the key factors to consider when determining the HS code for a specific jewellery item?

A: The key factors to consider include:

- Material: The primary material used to craft the jewellery item, such as gold, silver, platinum, base metal, or plastic.

- Stones: The type of stones used, whether precious, semi-precious, or imitation.

- Design and Function: The specific design and intended function of the jewellery item, such as rings, necklaces, bracelets, earrings, or pendants.

- Additional Features: Any additional features or embellishments, such as engravings, etching, or intricate designs.

Q: How can I find the correct HS code for a specific jewellery item?

A: There are several resources available to help determine the correct HS code for a specific jewellery item:

- Harmonized System Nomenclature: The official publication of the Harmonized System, available from the World Customs Organization (WCO).

- National Customs Websites: Most countries have national customs websites that provide information on HS codes and import/export regulations.

- Trade Associations and Industry Experts: Trade associations and industry experts can provide guidance on HS code classification for specific jewellery items.

Q: What happens if I use the wrong HS code for my jewellery item?

A: Using the wrong HS code can result in:

- Delayed Customs Clearance: Customs officials may require additional documentation or inspections if the HS code is incorrect, leading to delays in clearance.

- Incorrect Duty and Tax Calculation: Using the wrong HS code can lead to incorrect calculation of import duties and taxes, potentially resulting in financial penalties.

- Trade Disputes: Incorrect HS code classification can lead to trade disputes and legal complications.

Tips for Ensuring Accurate HS Code Classification

- Consult with Experts: Seek advice from customs brokers, trade associations, or industry experts to ensure accurate HS code classification.

- Thoroughly Research: Carefully review the Harmonized System Nomenclature and national customs regulations to determine the appropriate HS code for your jewellery item.

- Maintain Detailed Records: Keep detailed records of the HS codes used for all jewellery items, including documentation of any specific features or characteristics.

- Stay Updated: HS codes are subject to periodic updates and revisions. Stay informed about any changes to ensure compliance with the latest regulations.

Conclusion

The use of HS codes is essential for navigating the complex world of international jewellery trade. By understanding the structure and significance of these codes, businesses can ensure accurate customs declarations, streamline import/export processes, and make informed decisions regarding pricing, duties, and market analysis. By adhering to the principles of accuracy, documentation, and ongoing awareness, businesses can leverage the power of HS codes to foster smooth and efficient trade in the global jewellery market.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Labyrinth: A Comprehensive Guide to HS Codes for Jewellery Items. We appreciate your attention to our article. See you in our next article!