Navigating the Labyrinth: A Comprehensive Guide to Indian Customs Rules for Gold Jewellery

Related Articles: Navigating the Labyrinth: A Comprehensive Guide to Indian Customs Rules for Gold Jewellery

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Labyrinth: A Comprehensive Guide to Indian Customs Rules for Gold Jewellery. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Labyrinth: A Comprehensive Guide to Indian Customs Rules for Gold Jewellery

India, a nation renowned for its rich cultural heritage and exquisite craftsmanship, holds a deep-seated affection for gold jewellery. This precious metal, symbolizing prosperity and tradition, often finds its way across borders, necessitating a thorough understanding of the intricate regulations governing its import and export. This comprehensive guide aims to illuminate the complex landscape of Indian customs rules for gold jewellery, providing clarity and guidance for individuals seeking to navigate this intricate process.

Understanding the Basics: A Foundation for Compliance

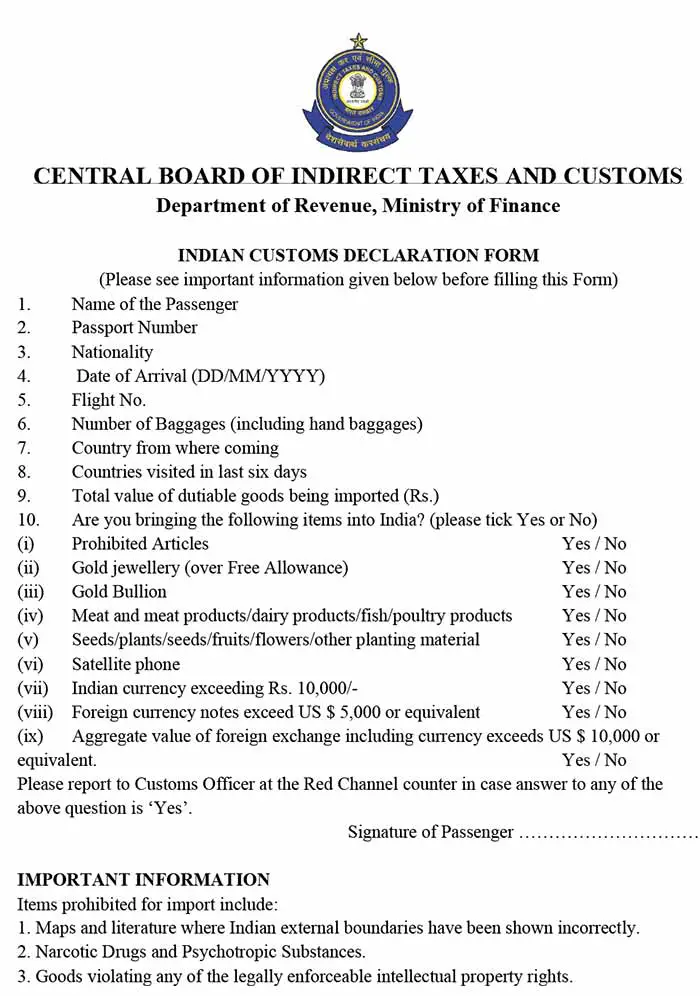

The Indian Customs Act, 1962, and its subsequent amendments form the bedrock of regulations surrounding gold jewellery. These regulations are designed to prevent illegal trade, protect national interests, and ensure transparency in the movement of precious metals. The Central Board of Indirect Taxes and Customs (CBIC) plays a crucial role in administering these rules, ensuring compliance and facilitating smooth trade practices.

Importation of Gold Jewellery: A Detailed Look

Importing gold jewellery into India requires meticulous adherence to specific guidelines. The following points outline the essential aspects of this process:

- Declaration and Documentation: All gold jewellery imported into India must be declared to the customs authorities. This declaration should include detailed information regarding the type, quantity, value, and origin of the jewellery. Supporting documentation, such as invoices, purchase receipts, and certificates of origin, are essential for verification purposes.

- Duty and Taxes: Imported gold jewellery is subject to customs duty and other taxes. The rates of duty vary depending on the type of jewellery, its origin, and the prevailing market conditions. The importer is responsible for paying these duties and taxes before the jewellery can be released.

- Restrictions and Limitations: Certain restrictions apply to the import of gold jewellery. For instance, there are limits on the quantity of gold jewellery that can be imported without prior permission. Additionally, the import of specific types of jewellery, such as antique or heritage pieces, may require additional documentation and approvals.

- Customs Clearance: Once the declaration and documentation are submitted, the customs authorities conduct a thorough examination of the imported gold jewellery. This process may involve physical inspection, verification of documentation, and assessment of duty and taxes. Upon successful clearance, the importer receives the necessary permits to release the jewellery.

Exportation of Gold Jewellery: A Guide for Exporters

Exporting gold jewellery from India involves similar procedures as importation. The following aspects are critical for exporters to understand:

- Documentation and Declaration: Exporters must provide accurate documentation and declarations to the customs authorities. These documents should include details about the type, quantity, value, and destination of the exported jewellery.

- Export License: Depending on the type and value of the gold jewellery being exported, an export license may be required. The Ministry of Commerce and Industry issues these licenses, ensuring compliance with international trade regulations.

- Duty Drawback: In certain cases, exporters may be eligible for duty drawback, which is a refund of import duties paid on raw materials or components used in the manufacture of exported gold jewellery. This mechanism encourages exports and promotes the competitiveness of Indian gold jewellery in international markets.

- Compliance with International Regulations: Exporters must adhere to international regulations and standards related to gold jewellery. These regulations may pertain to hallmarking, purity, and ethical sourcing of gold.

Navigating the Regulations: Essential Tips for Individuals

Individuals travelling to or from India with gold jewellery should be aware of the following key points:

- Declaration and Limits: Travellers must declare all gold jewellery they are carrying, whether for personal use or as gifts. The permissible limit for gold jewellery varies depending on the traveller’s nationality and the purpose of the journey.

- Duty Exemption: Travellers may be eligible for duty exemption on a limited amount of gold jewellery for personal use. The specific exemption limits are determined by the Indian Customs Department and may vary depending on the traveller’s status.

- Documentation: Travellers should carry relevant documentation, such as purchase receipts or invoices, to support their declarations. This documentation helps to verify the authenticity and value of the jewellery and facilitates smoother customs clearance.

Frequently Asked Questions: Addressing Common Concerns

1. What are the permissible limits for gold jewellery that can be imported or exported by individuals?

The permissible limits for gold jewellery vary depending on the traveller’s nationality, purpose of travel, and the country of origin or destination. It is advisable to consult with the Indian Customs Department or the relevant embassy for the most up-to-date information.

2. What are the customs duty rates applicable to gold jewellery?

The customs duty rates for gold jewellery are subject to change and are dependent on factors such as the type of jewellery, its origin, and the prevailing market conditions. It is recommended to contact the Indian Customs Department or a customs broker for the most accurate and current information.

3. What documentation is required for importing or exporting gold jewellery?

The specific documentation requirements vary depending on the type, quantity, and value of the gold jewellery being imported or exported. However, common documents include invoices, purchase receipts, certificates of origin, export licenses (if applicable), and other supporting documentation as deemed necessary by the customs authorities.

4. Are there any restrictions on the import or export of antique or heritage gold jewellery?

Yes, there are specific restrictions on the import or export of antique or heritage gold jewellery. These restrictions may require additional documentation, such as certificates of authenticity and provenance, and may involve approvals from the Archaeological Survey of India or other relevant authorities.

5. How can I obtain an export license for gold jewellery?

Export licenses for gold jewellery are issued by the Ministry of Commerce and Industry. The application process involves submitting specific documentation, including details about the type, quantity, and destination of the gold jewellery being exported. The Ministry reviews the application and grants the license based on compliance with relevant regulations.

Conclusion: Ensuring Smooth Compliance and Fostering Trade

Navigating the intricacies of Indian customs rules for gold jewellery requires a clear understanding of the relevant regulations, documentation requirements, and procedures. By diligently adhering to these guidelines, individuals and businesses can ensure smooth compliance, minimize delays, and foster a secure and transparent trade environment. It is essential to stay informed about any changes in customs regulations, consult with experts when necessary, and prioritize ethical practices in the import and export of gold jewellery, contributing to the responsible and sustainable growth of this vital sector.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Labyrinth: A Comprehensive Guide to Indian Customs Rules for Gold Jewellery. We hope you find this article informative and beneficial. See you in our next article!