Navigating the Path to Gold Importation in Australia: A Comprehensive Guide

Related Articles: Navigating the Path to Gold Importation in Australia: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Path to Gold Importation in Australia: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Path to Gold Importation in Australia: A Comprehensive Guide

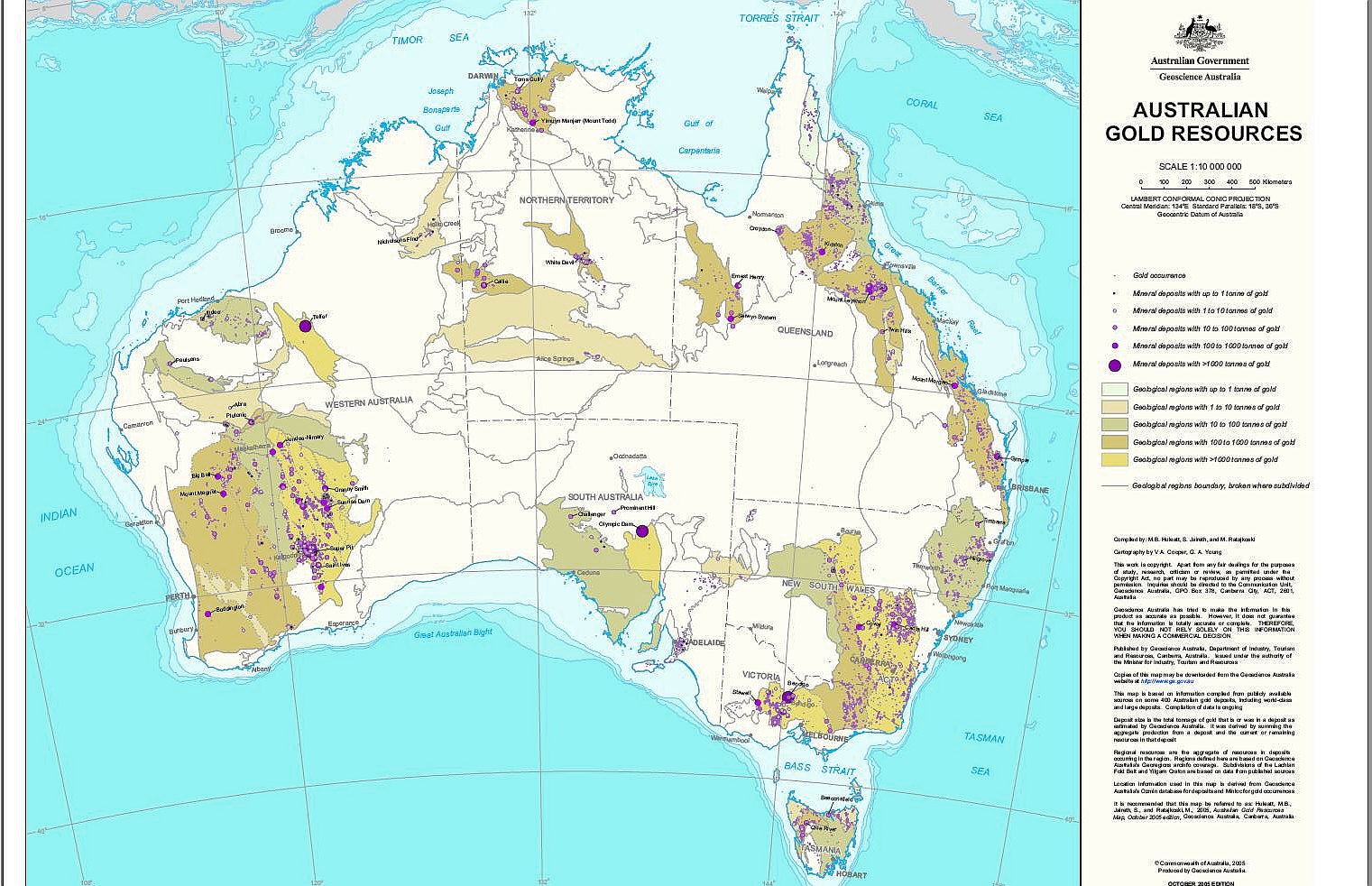

Australia, renowned for its abundant natural resources, holds a significant position in the global gold market. The country’s robust mining industry, combined with its strategic location, makes it an attractive destination for gold importers. However, navigating the intricacies of gold importation into Australia requires a comprehensive understanding of the regulations, procedures, and associated complexities. This guide aims to provide a detailed overview of the process, shedding light on the essential aspects to ensure a smooth and successful importation.

Understanding the Regulatory Landscape

Importing gold into Australia is subject to stringent regulations enforced by various government agencies. The Australian Taxation Office (ATO) plays a pivotal role in managing the import process, ensuring compliance with tax laws and regulations. Additionally, the Australian Border Force (ABF) oversees the physical entry of gold into the country, implementing security measures and enforcing import restrictions.

Key Regulatory Considerations

- Customs Tariff: Gold imported into Australia is subject to a customs duty, which varies depending on the type of gold and its origin.

- GST: The Goods and Services Tax (GST) applies to the value of the imported gold.

- Import Permits: Depending on the origin and type of gold, specific import permits might be required.

- Compliance with Sanctions: Gold importation must comply with international sanctions imposed by Australia.

- Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF): Importers must adhere to AML/CTF regulations, including due diligence procedures and record-keeping requirements.

The Importation Process: A Step-by-Step Guide

-

Planning and Preparation:

- Identify the source: Determine the origin of the gold and ensure it complies with Australian regulations.

- Assess import requirements: Research and understand the specific import regulations and permits required for the type of gold being imported.

- Secure necessary documentation: Obtain the relevant documentation, including invoices, certificates of origin, and other supporting papers.

- Choose a reputable importer: Select a licensed and experienced importer who can handle the import process efficiently.

-

Declaration and Customs Clearance:

- Submit import declaration: The importer must submit an import declaration to the ABF, providing details of the gold shipment.

- Customs inspection: The ABF may conduct physical inspections of the gold shipment to verify its authenticity and compliance with regulations.

- Payment of duties and taxes: The importer must pay the applicable customs duties and GST upon clearance of the gold.

-

Gold Refining and Certification:

- Refining: Imported gold may require refining to achieve the desired purity level.

- Certification: The refined gold must be certified by a reputable laboratory, confirming its purity and quality.

Benefits of Importing Gold into Australia

- Investment Opportunity: Gold is a valuable asset that offers diversification benefits and potential for capital appreciation.

- Safe Haven Asset: During economic uncertainty or market volatility, gold tends to hold its value, providing a safe haven for investors.

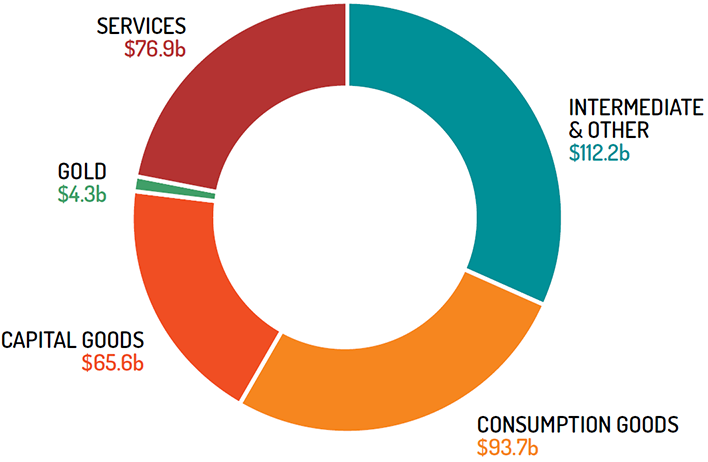

- Industrial Applications: Gold is used in various industries, including electronics, medicine, and jewelry, creating a demand for imported gold.

- Contribution to the Economy: Gold importation contributes to the Australian economy by supporting businesses involved in the import, refining, and trading of gold.

FAQs on Importing Gold into Australia

1. What are the requirements for importing gold into Australia?

The specific requirements vary depending on the type of gold, its origin, and the purpose of importation. However, generally, importers must comply with customs regulations, obtain necessary permits, and adhere to AML/CTF requirements.

2. What are the customs duties and taxes applicable to gold imports?

The customs duty and GST rates applicable to imported gold depend on the type of gold and its origin. It’s crucial to consult the ATO website for current rates and regulations.

3. How can I find a reputable gold importer in Australia?

Researching licensed and experienced importers is essential. Look for companies with a proven track record and positive client testimonials.

4. What are the risks associated with importing gold into Australia?

Potential risks include non-compliance with regulations, delays in customs clearance, and fluctuations in gold prices.

5. What are the legal ramifications of importing gold illegally?

Importing gold without the necessary permits or failing to comply with regulations can result in significant penalties, including fines and potential imprisonment.

Tips for Successful Gold Importation into Australia

- Engage with an experienced importer: Partner with a reputable importer who has expertise in navigating the Australian import process.

- Thorough research: Understand the specific regulations and requirements for your intended gold import.

- Accurate documentation: Ensure all necessary documents are complete and accurate to avoid delays in customs clearance.

- Compliance with AML/CTF regulations: Implement robust AML/CTF measures to mitigate potential risks.

- Maintain proper record-keeping: Keep detailed records of all import transactions for future reference and audit purposes.

Conclusion

Importing gold into Australia presents both opportunities and challenges. By understanding the regulatory landscape, adhering to the import process, and seeking guidance from experienced professionals, importers can navigate the complexities and successfully bring gold into the country. The benefits of gold importation, including investment potential, safe haven attributes, and industrial applications, make it an attractive proposition for individuals and businesses seeking to capitalize on the Australian gold market. However, it is crucial to prioritize compliance with regulations and best practices to ensure a smooth and successful importation experience.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Path to Gold Importation in Australia: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!