Navigating the World of Jewelry: Understanding HS Codes for Smooth Trade

Related Articles: Navigating the World of Jewelry: Understanding HS Codes for Smooth Trade

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the World of Jewelry: Understanding HS Codes for Smooth Trade. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the World of Jewelry: Understanding HS Codes for Smooth Trade

The global jewelry market is a vibrant tapestry of craftsmanship, artistry, and commerce. As with any international trade, navigating the complexities of import and export requires a thorough understanding of regulations, customs, and specific classifications. One crucial element in this intricate system is the Harmonized System (HS) code, a standardized international nomenclature that provides a unique identifier for every type of product traded across borders.

Decoding the Jewelry HS Code: A Foundation for Trade

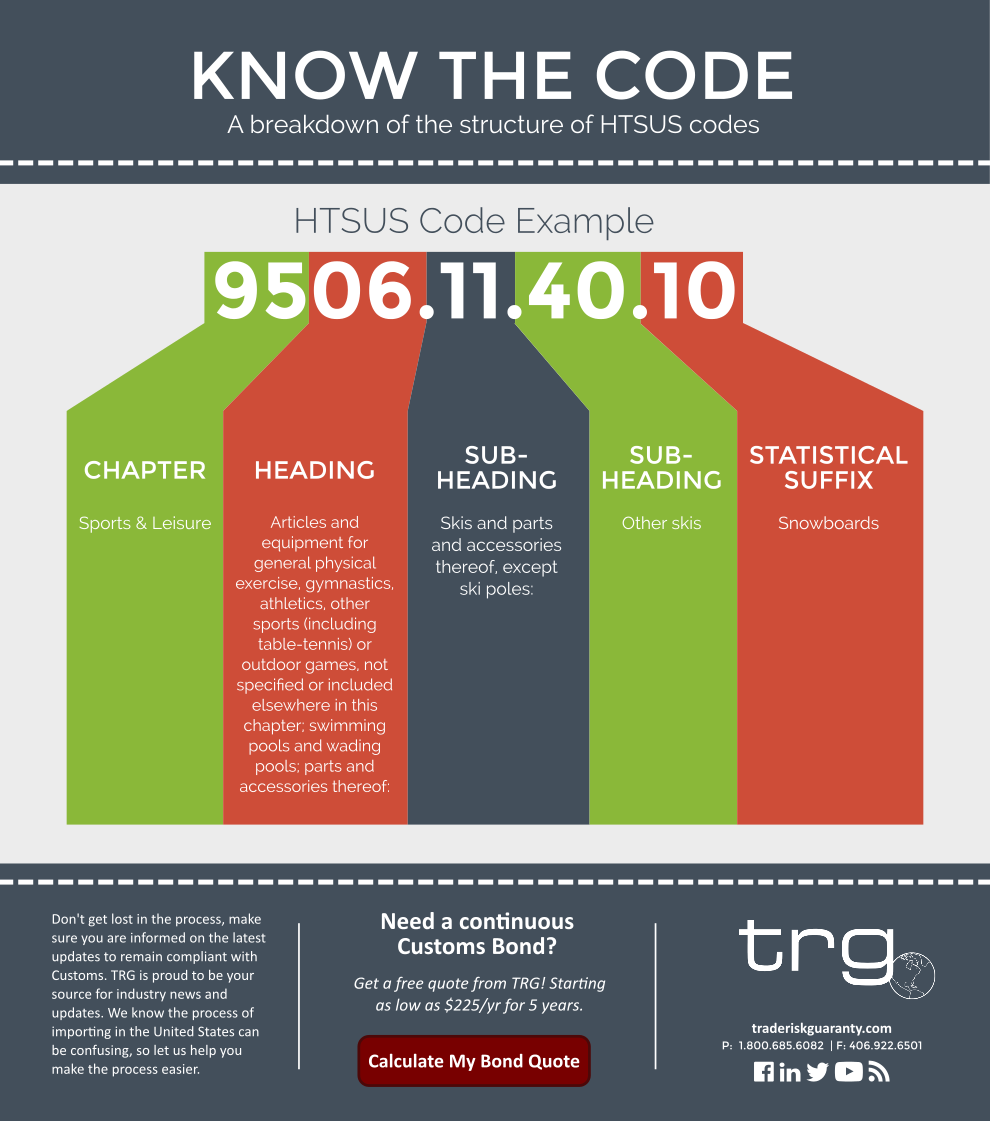

HS codes are six-digit numerical codes, often expanded to eight or ten digits for more specific classifications. These codes are essential for:

- Customs Clearance: HS codes enable customs authorities to quickly identify the nature of goods being imported or exported, facilitating efficient clearance procedures.

- Tariff Determination: HS codes directly influence the tariff rates applied to goods, impacting the overall cost of importing or exporting jewelry.

- Trade Statistics: Accurate HS code usage provides valuable data for market analysis, trade monitoring, and policy decisions.

- Regulatory Compliance: HS codes ensure adherence to specific regulations and restrictions related to jewelry materials, design, and origin.

Understanding HS Codes for Jewelry: A Comprehensive Guide

The HS code for jewelry falls under Chapter 71: Pearls, precious and semi-precious stones, precious metals, metals clad with precious metal and articles thereof; imitation jewelry; coins. However, the specific HS code for a particular piece of jewelry depends on its material composition, design, and intended use.

Here’s a breakdown of common HS codes for jewelry:

71.13: Articles of jewelry and parts thereof, of precious metal or of metal clad with precious metal

-

7113.11: Of gold

- Includes rings, earrings, necklaces, bracelets, pendants, brooches, and other jewelry items made entirely of gold.

-

7113.12: Of platinum

- Covers jewelry crafted from platinum, including rings, earrings, necklaces, and more.

-

7113.19: Of other precious metals

- Encompasses jewelry made of silver, palladium, or other precious metals.

-

7113.20: Of metal clad with precious metal

- Covers jewelry where a base metal is coated with a layer of precious metal, such as gold-plated or silver-plated jewelry.

71.14: Articles of jewelry and parts thereof, of base metal

-

7114.10: Of silver

- Includes jewelry made primarily of silver, such as sterling silver jewelry.

-

7114.20: Of other base metals

- Encompasses jewelry made of copper, brass, nickel, or other base metals.

71.15: Articles of jewelry and parts thereof, of imitation precious metal

-

7115.10: Of imitation gold

- Includes jewelry made to resemble gold but crafted from base metals or alloys.

-

7115.20: Of imitation silver

- Covers jewelry designed to mimic silver, but made from non-silver materials.

-

7115.90: Of imitation other precious metals

- Includes jewelry imitating other precious metals like platinum or palladium.

71.16: Imitation jewelry, not elsewhere specified or included

-

7116.10: Of precious metal or of metal clad with precious metal

- Covers imitation jewelry that utilizes precious metals or metal clad with precious metal.

-

7116.20: Of base metal

- Includes imitation jewelry made from base metals.

-

7116.90: Of other materials

- Encompasses imitation jewelry crafted from materials like plastic, glass, or wood.

71.17: Coins

-

7117.11: Of gold

- Includes gold coins, both circulating and commemorative.

-

7117.19: Of other precious metals

- Covers coins made from silver, platinum, or other precious metals.

-

7117.20: Of base metal

- Encompasses coins made from base metals like copper or nickel.

Navigating the Nuances: Factors Influencing HS Codes

While the above provides a general framework, several factors can influence the specific HS code assigned to a piece of jewelry:

- Material Composition: The primary material used in the jewelry piece (gold, silver, platinum, base metal, etc.) is a key determinant of its HS code.

- Design and Functionality: The design and intended use of the jewelry can affect its classification. For example, a simple gold band ring would have a different HS code than a complex diamond-studded pendant.

- Gemstones and Precious Stones: The presence of gemstones or precious stones, their type, and their setting significantly influence the HS code.

- Origin: The country of origin of the jewelry can impact its HS code, particularly for certain types of gemstones or materials.

Seeking Expert Guidance: Ensuring Accuracy and Compliance

Determining the correct HS code for a specific jewelry item can be complex, requiring careful consideration of its characteristics and relevant regulations. It is highly recommended to consult with a customs broker or an experienced trade professional for accurate classification.

FAQs: Addressing Common Queries on HS Codes for Jewelry

Q: How do I find the correct HS code for my jewelry?

A: You can use online resources like the World Customs Organization’s (WCO) Harmonized System Nomenclature or consult with a customs broker or trade professional for assistance.

Q: Is there a specific HS code for jewelry with gemstones?

A: Yes, the presence of gemstones will affect the HS code. The specific code will depend on the type of gemstone, its cut, and its setting within the jewelry piece.

Q: What happens if I use the wrong HS code?

A: Using an incorrect HS code can lead to delays in customs clearance, incorrect tariff charges, and potential penalties.

Q: Can I change the HS code after I have submitted my import/export declaration?

A: It is possible to amend the HS code, but it may require additional documentation and approval from customs authorities.

Q: What are the benefits of using the correct HS code?

A: Accurate HS code usage ensures smooth customs clearance, correct tariff determination, and compliance with trade regulations.

Tips for Utilizing HS Codes Effectively:

- Thorough Research: Invest time in understanding the HS code system and its application to jewelry.

- Expert Consultation: Seek guidance from customs brokers or trade professionals for accurate code determination.

- Documentation: Maintain accurate records of the HS codes used for all import/export transactions.

- Stay Updated: Keep abreast of any changes or updates to HS codes and related regulations.

Conclusion: The HS Code – A Vital Tool for Jewelry Trade

HS codes are an indispensable tool for navigating the global jewelry trade. By understanding the intricacies of HS codes and utilizing them correctly, businesses can ensure smooth customs clearance, accurate tariff determination, and compliance with international regulations. Investing in knowledge and seeking expert guidance when needed can significantly enhance the efficiency and profitability of jewelry import and export operations.

Closure

Thus, we hope this article has provided valuable insights into Navigating the World of Jewelry: Understanding HS Codes for Smooth Trade. We thank you for taking the time to read this article. See you in our next article!