The Allure of Precious Metals: Exploring Jewellery as an Investment

Related Articles: The Allure of Precious Metals: Exploring Jewellery as an Investment

Introduction

With great pleasure, we will explore the intriguing topic related to The Allure of Precious Metals: Exploring Jewellery as an Investment. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Allure of Precious Metals: Exploring Jewellery as an Investment

The world of investment is vast and multifaceted, with options ranging from traditional stocks and bonds to the more unconventional realm of collectibles. Among these, jewellery, particularly pieces crafted from precious metals and gemstones, has long held a unique appeal. While its aesthetic value is undeniable, the question of whether it constitutes a sound investment remains a subject of debate. This article aims to provide a comprehensive exploration of jewellery as an investment vehicle, delving into its potential benefits, risks, and factors to consider when making informed decisions.

Understanding the Value Proposition of Jewellery

Jewellery’s allure as an investment stems from its inherent characteristics:

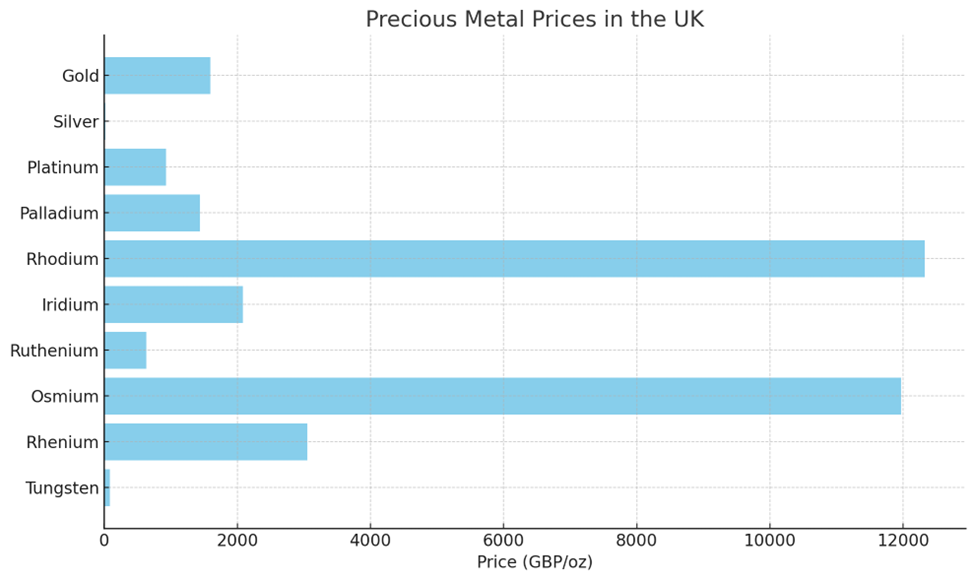

- Intrinsic Value: Precious metals like gold, silver, and platinum possess inherent value independent of their artistic form. Their prices fluctuate based on global market dynamics, supply and demand, and economic conditions.

- Rarity and Demand: Certain gemstones, due to their scarcity and unique properties, command high prices. The desirability of specific stones, like diamonds, sapphires, and emeralds, is often driven by historical significance, cultural preferences, and marketing efforts.

- Emotional and Sentimental Value: Jewellery often carries emotional significance, serving as heirlooms passed down through generations or representing milestones in life. This sentimental value can contribute to its perceived worth, especially for pieces with unique provenance or historical significance.

- Collectibility: Certain jewellery pieces, particularly those by renowned designers or with historical significance, become highly sought-after collectibles. Their value can appreciate significantly over time, driven by demand from collectors and enthusiasts.

Navigating the Investment Landscape

While jewellery holds inherent potential as an investment, it’s crucial to approach it with a discerning eye and a clear understanding of its complexities. Here’s a breakdown of key factors to consider:

1. The Market Dynamics:

- Volatility: Precious metal prices, like those of gold and silver, are subject to market fluctuations influenced by various factors, including economic conditions, geopolitical events, and investor sentiment. This volatility can lead to significant price swings, both positive and negative.

- Supply and Demand: The availability of precious metals and gemstones influences their market prices. Increased demand, coupled with limited supply, can drive prices upward, while oversupply can lead to price declines.

- Economic Factors: Global economic trends, such as inflation, interest rates, and currency fluctuations, can impact the value of precious metals. In times of economic uncertainty, investors often seek refuge in gold, driving its price higher.

2. The Importance of Due Diligence:

- Authenticity and Provenance: Ensuring the authenticity of a piece is paramount. Obtaining certificates of authenticity from reputable gemological labs and researching the history of a piece are essential steps in verifying its value.

- Quality and Craftsmanship: The quality of materials and craftsmanship significantly influence a piece’s value. Fine jewellery, meticulously crafted with high-quality materials, tends to hold its value better than mass-produced pieces.

- Design and Style: Current trends and fashion preferences can influence the desirability of certain styles. Timeless designs, those that remain aesthetically pleasing over time, are generally better investments.

3. Understanding the Risks:

- Liquidity: Selling jewellery can be challenging, especially for unique or specialized pieces. Finding a buyer willing to pay fair market value can take time and effort.

- Storage and Insurance: Properly storing and insuring jewellery against loss, theft, or damage is essential. Secure storage options, such as safe deposit boxes or specialized jewellery vaults, are recommended.

- Expertise: Assessing the value of jewellery requires knowledge of gemology, metals, and design. Consulting with reputable jewellers or gemologists is crucial for making informed decisions.

4. The Role of Market Trends:

- Emerging Trends: The jewellery market is dynamic, with emerging trends influencing demand and value. Understanding these trends, such as the increasing popularity of ethical sourcing and sustainable practices, can provide insights into potential investment opportunities.

- Vintage and Antique Jewellery: Vintage and antique jewellery pieces, particularly those with historical significance or by renowned designers, can appreciate significantly over time.

- Investment-Specific Jewellery: Some jewellery pieces are specifically designed for investment purposes, featuring high-quality materials and craftsmanship. These pieces may offer a higher potential for appreciation, but also carry higher risk.

5. The Ethical Considerations:

- Sustainable Practices: Choosing jewellery crafted with ethically sourced materials and manufactured using sustainable practices is increasingly important to environmentally conscious investors.

- Conflict-Free Diamonds: Supporting the diamond industry’s efforts to ensure conflict-free sourcing is a crucial ethical consideration for investors.

FAQs: Unpacking the Investment Landscape

1. Is it a good investment for everyone?

Jewellery is not a one-size-fits-all investment. It’s best suited for investors with a long-term perspective, a tolerance for risk, and a willingness to conduct thorough research and due diligence.

2. What type of jewellery is best for investment?

High-quality pieces crafted from precious metals and gemstones, particularly those with historical significance, unique design, or from renowned designers, generally offer greater potential for appreciation.

3. How can I determine the value of a piece?

Consult with a reputable jeweller or gemologist for an appraisal. Ensure the appraisal is conducted by a qualified professional and includes a detailed report outlining the piece’s characteristics, authenticity, and estimated value.

4. How can I sell my jewellery?

Consider reputable jewellers, auction houses, or online platforms specializing in luxury goods. Research potential buyers thoroughly and understand their fees and commissions.

5. What are the tax implications of selling jewellery?

Capital gains tax may apply to profits realized from selling jewellery, depending on your location and the duration of ownership. Consult with a financial advisor for specific guidance.

Tips for Making Informed Decisions:

- Start with a clear investment goal: Define your investment objectives and risk tolerance.

- Research thoroughly: Educate yourself about the jewellery market, understand current trends, and explore different investment options.

- Seek expert advice: Consult with a reputable jeweller, gemologist, or financial advisor for guidance.

- Invest in quality: Prioritize high-quality pieces crafted with precious metals and gemstones.

- Diversify your portfolio: Don’t put all your investment eggs in one basket. Diversify your portfolio with other assets.

- Store securely: Invest in secure storage options to protect your jewellery from loss or damage.

- Maintain proper documentation: Keep records of purchases, appraisals, and any other relevant documentation.

Conclusion:

Jewellery can be a compelling investment option, offering the potential for both financial gain and emotional satisfaction. However, it’s crucial to approach it with a discerning eye, understanding the risks and complexities involved. Thorough research, expert advice, and a long-term perspective are essential for navigating the intricate world of jewellery investment. By considering the factors outlined in this article, investors can make informed decisions, maximizing their potential for appreciation while mitigating potential risks.

Closure

Thus, we hope this article has provided valuable insights into The Allure of Precious Metals: Exploring Jewellery as an Investment. We thank you for taking the time to read this article. See you in our next article!