The Allure of Precious Metals: Exploring Jewelry as an Investment

Related Articles: The Allure of Precious Metals: Exploring Jewelry as an Investment

Introduction

With great pleasure, we will explore the intriguing topic related to The Allure of Precious Metals: Exploring Jewelry as an Investment. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Allure of Precious Metals: Exploring Jewelry as an Investment

In a world of fluctuating financial markets, investors are constantly seeking avenues to diversify their portfolios and potentially secure their wealth. While traditional assets like stocks, bonds, and real estate remain popular, the allure of tangible assets, particularly precious metals, has been gaining traction. Among these, jewelry has emerged as an intriguing investment option, drawing attention for its potential to offer both aesthetic appeal and financial value.

Understanding the Intrinsic Value of Jewelry

The core of jewelry’s investment potential lies in the intrinsic value of the precious metals used in its creation. Gold, silver, platinum, and other precious metals have inherent worth based on their scarcity, durability, and historical significance. These metals are considered safe haven assets, meaning they tend to hold their value or even appreciate during times of economic uncertainty.

Beyond the Metal: Factors Influencing Jewelry’s Value

While the precious metal content is a primary factor, other elements significantly contribute to the overall value of a piece of jewelry. These include:

- Design and Craftsmanship: Unique designs, intricate craftsmanship, and the reputation of the designer or maker can significantly impact the value.

- Rarity and Historical Significance: Limited-edition pieces, vintage items, or those with historical connections often command higher prices.

- Gemstones: The quality, size, and rarity of gemstones incorporated into jewelry play a crucial role in determining its value.

- Brand Reputation: Renowned jewelry houses and designers carry a premium, adding to the overall value of their creations.

- Condition: The condition of a piece, including its wear and tear, can influence its market value.

The Investment Landscape: Examining the Pros and Cons

While jewelry offers a compelling investment proposition, it’s essential to approach it with a clear understanding of its advantages and limitations:

Potential Benefits:

- Tangible Asset: Unlike intangible assets like stocks or bonds, jewelry is a physical asset that can be held and enjoyed.

- Potential for Appreciation: Precious metals tend to appreciate in value over time, particularly during periods of economic instability.

- Diversification: Jewelry can diversify a portfolio by offering an alternative to traditional investments.

- Hedge Against Inflation: Precious metals can act as a hedge against inflation, as their value tends to rise with inflation.

- Emotional Value: Jewelry often holds sentimental value, providing an emotional connection beyond its financial worth.

Potential Drawbacks:

- Liquidity: Selling jewelry can be time-consuming and may require professional appraisal and specialized buyers.

- Market Volatility: The price of precious metals can fluctuate, leading to potential losses.

- Storage and Insurance: Jewelry requires secure storage and appropriate insurance to protect against theft or damage.

- Expertise Required: Evaluating the quality and value of jewelry requires expertise and knowledge of the market.

- High Entry Cost: Investment-grade jewelry can be expensive, requiring a significant initial investment.

Navigating the Investment Journey: Tips for Success

To maximize the potential of jewelry as an investment, consider the following strategies:

- Invest in Quality: Focus on pieces made with high-quality precious metals and gemstones, as they tend to hold their value better.

- Research and Knowledge: Educate yourself about the market, understand the factors influencing value, and seek expert advice when necessary.

- Buy from Reputable Sources: Purchase jewelry from reputable dealers or auction houses to ensure authenticity and quality.

- Diversify: Don’t put all your investment eggs in one basket. Diversify your jewelry portfolio by investing in different metals, gemstones, and styles.

- Secure Storage: Invest in a safe or safe deposit box to protect your jewelry from theft or damage.

- Insurance: Obtain adequate insurance coverage to protect your jewelry against loss or damage.

Frequently Asked Questions (FAQs)

1. Is jewelry a good investment for everyone?

While jewelry can be a compelling investment option, it’s not suitable for everyone. It requires a certain level of financial resources, knowledge of the market, and a long-term investment horizon.

2. How can I determine the value of my jewelry?

To determine the value of your jewelry, it’s recommended to seek an appraisal from a qualified and certified gemologist or jewelry appraiser. They can assess the quality of the metals, gemstones, and craftsmanship to provide a fair market value.

3. What are the best metals to invest in?

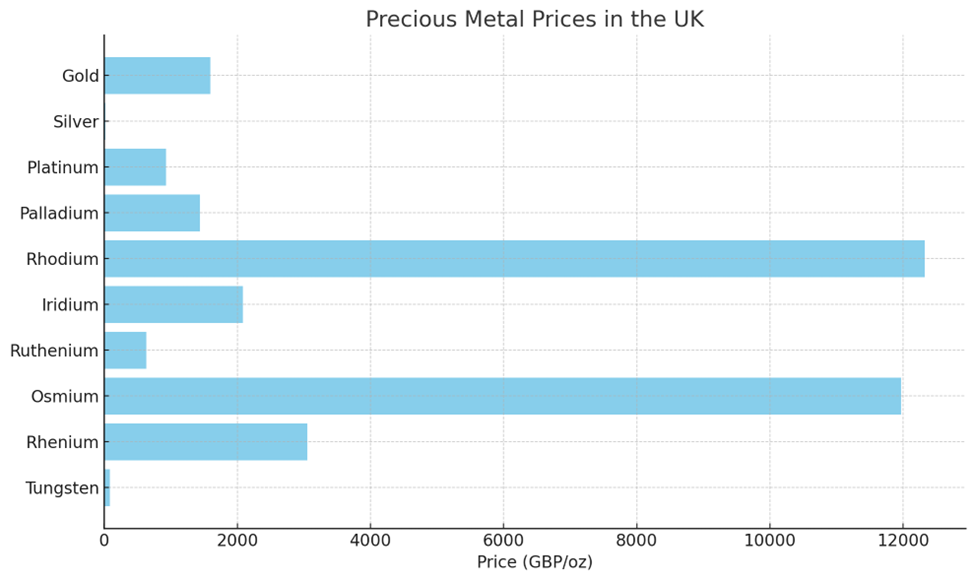

Gold and platinum are generally considered the most stable and valuable precious metals for investment purposes. However, silver and other precious metals can also offer potential for appreciation.

4. Is it better to invest in new or vintage jewelry?

Both new and vintage jewelry can be good investments, but their value factors differ. New jewelry may offer potential for appreciation based on current trends, while vintage pieces may have historical significance and collector value.

5. How can I sell my jewelry for the best price?

To sell your jewelry for the best price, consider working with reputable jewelry dealers, auction houses, or online platforms specializing in precious metals and gemstones. Ensure you have a professional appraisal to support your asking price.

Conclusion

Jewelry, with its intrinsic value tied to precious metals and captivating designs, presents a unique investment opportunity. While it’s not without its challenges, understanding the factors influencing value, navigating the market wisely, and embracing a long-term perspective can potentially yield rewarding returns. However, it’s crucial to remember that investing in jewelry requires careful consideration, research, and a commitment to responsible ownership. By approaching it with informed decision-making and a balanced perspective, investors can explore the potential of jewelry as a valuable addition to their portfolios.

Closure

Thus, we hope this article has provided valuable insights into The Allure of Precious Metals: Exploring Jewelry as an Investment. We appreciate your attention to our article. See you in our next article!