The Allure of Silver: Examining the Investment Potential of Silver Jewelry

Related Articles: The Allure of Silver: Examining the Investment Potential of Silver Jewelry

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Allure of Silver: Examining the Investment Potential of Silver Jewelry. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Allure of Silver: Examining the Investment Potential of Silver Jewelry

Silver, a lustrous and enduring metal, has captivated humanity for centuries. Its value transcends its aesthetic appeal, extending into the realm of investment. While silver jewelry often serves as a cherished adornment, its potential as a financial asset merits careful consideration. This exploration delves into the intricacies of silver jewelry as an investment, analyzing its historical performance, present market dynamics, and future prospects.

Understanding Silver’s Intrinsic Value:

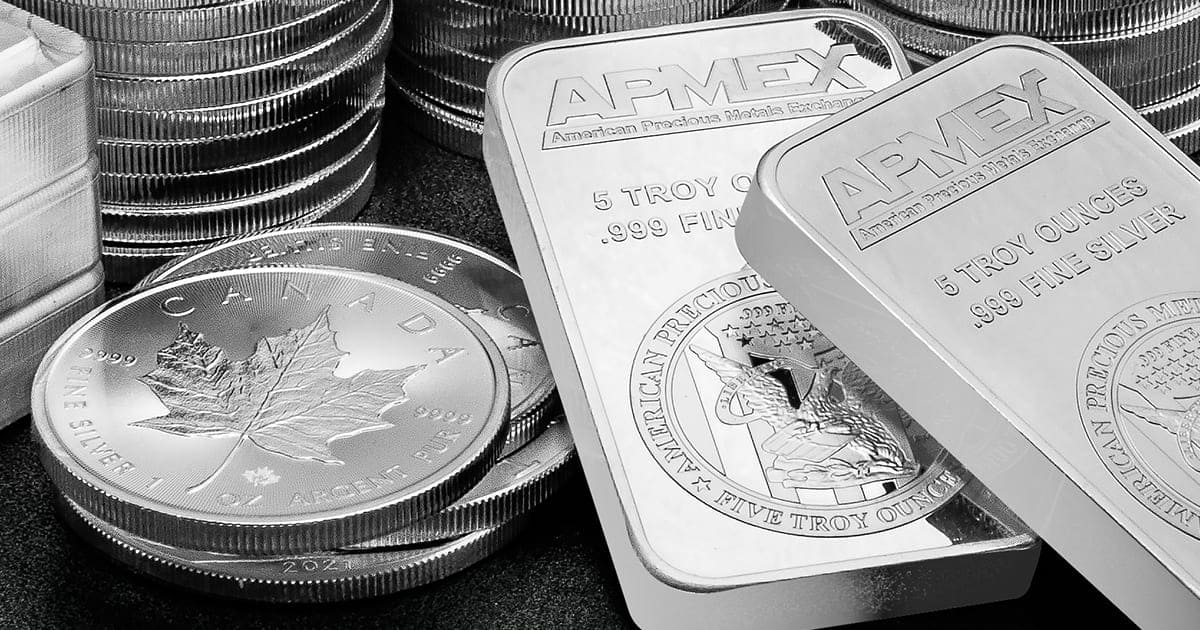

Silver’s value stems from its inherent properties, making it a valuable commodity across diverse industries. Its exceptional conductivity, malleability, and antimicrobial qualities have cemented its role in electronics, manufacturing, and healthcare.

Silver as a Safe Haven Asset:

In times of economic uncertainty, investors often seek refuge in safe haven assets, which tend to retain or increase their value during market downturns. Silver, historically, has exhibited characteristics of a safe haven asset, demonstrating resilience during periods of inflation and geopolitical instability.

The Fluctuating Nature of Silver Prices:

Silver prices are subject to volatility, influenced by a complex interplay of factors:

- Supply and Demand: The global supply of silver is influenced by mining operations, recycling efforts, and industrial demand. Fluctuations in these factors directly impact prices.

- Economic Conditions: Economic growth, interest rates, and inflation all play a role in shaping silver’s value. During periods of economic expansion, demand for silver often increases, pushing prices upward.

- Investment Sentiment: Speculative trading and investor sentiment can significantly impact silver prices. Large-scale buying or selling can create short-term price swings.

- Geopolitical Events: Global events, such as wars or political instability, can influence silver prices.

Factors to Consider When Investing in Silver Jewelry:

While silver jewelry can serve as an investment, it’s crucial to understand the nuances involved:

- Purity and Hallmarks: The purity of silver is measured in fineness, expressed as a percentage or a karat system. Higher purity silver commands a higher price. Look for hallmarks indicating the purity of the silver.

- Design and Craftsmanship: Unique designs and intricate craftsmanship can enhance the value of silver jewelry. Pieces by renowned designers or with historical significance often fetch higher prices.

- Condition and Wear: The condition of silver jewelry significantly impacts its value. Well-maintained pieces with minimal wear and tear are more desirable.

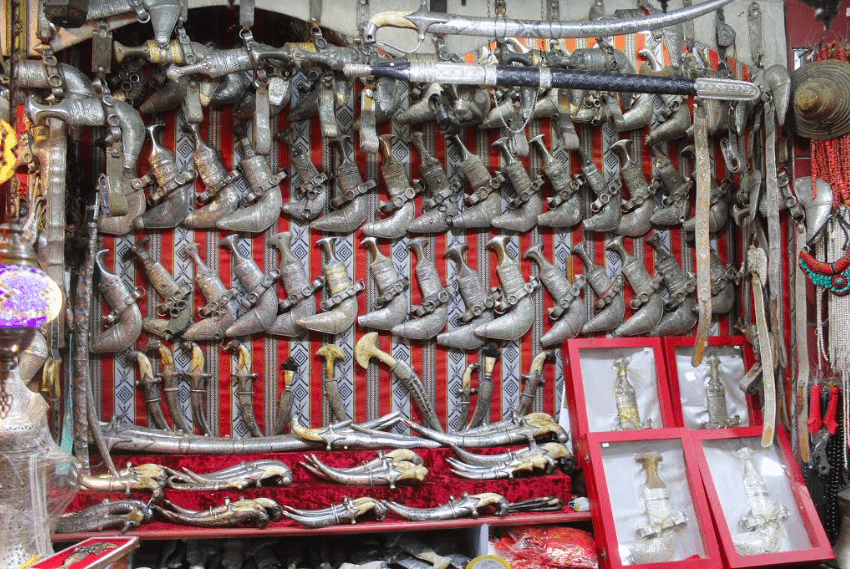

- Rarity and Collectibility: Rare or limited-edition silver jewelry pieces can be highly sought after by collectors, driving up their value.

Advantages of Investing in Silver Jewelry:

- Tangible Asset: Unlike intangible investments like stocks or bonds, silver jewelry offers tangible ownership.

- Potential for Appreciation: Silver prices can fluctuate, offering the potential for capital appreciation over time.

- Hedging Against Inflation: Silver, like gold, is often seen as a hedge against inflation, as its value tends to rise during periods of rising prices.

- Aesthetic Appeal: Silver jewelry combines investment potential with aesthetic appeal, serving as both a financial asset and a cherished possession.

Disadvantages of Investing in Silver Jewelry:

- Liquidity: Silver jewelry can be challenging to sell quickly and easily, especially for unique or antique pieces.

- Storage Costs: Proper storage is crucial for maintaining the condition of silver jewelry, which can incur costs.

- Insurance: Valuable silver jewelry requires adequate insurance to protect against theft or damage.

- Market Volatility: Silver prices are subject to significant fluctuations, which can lead to losses.

Tips for Investing in Silver Jewelry:

- Research: Thoroughly research the silver market, including historical price trends, current market dynamics, and factors that influence prices.

- Seek Expertise: Consult with reputable jewelers or silver experts to gain insights into the quality, authenticity, and potential value of specific pieces.

- Consider Your Investment Goals: Define your investment objectives, including your risk tolerance, time horizon, and desired return.

- Diversify Your Portfolio: Don’t solely rely on silver jewelry as an investment. Diversify your portfolio with other asset classes to mitigate risk.

- Secure Storage: Invest in a secure storage solution to protect your silver jewelry from theft, damage, or environmental factors.

FAQs Regarding Silver Jewelry as an Investment:

1. Is silver jewelry a good investment for everyone?

Silver jewelry is not a suitable investment for everyone. It requires a certain level of risk tolerance, understanding of the silver market, and willingness to hold the investment for an extended period.

2. How can I determine the value of my silver jewelry?

Consult with a reputable jeweler or appraiser to obtain a professional valuation. Factors such as purity, design, condition, and rarity will influence the assessment.

3. How can I sell my silver jewelry?

You can sell your silver jewelry through reputable jewelers, online marketplaces, or auction houses. Research potential buyers and compare offers before making a decision.

4. Are there any tax implications associated with selling silver jewelry?

Capital gains tax may be applicable if you sell silver jewelry for a profit. Consult with a tax professional for guidance.

5. What are the risks associated with investing in silver jewelry?

Risks include price volatility, liquidity challenges, storage costs, and the potential for theft or damage.

Conclusion:

While silver jewelry can offer investment potential, it’s not a guaranteed path to wealth. Understanding the intricacies of the silver market, carefully evaluating individual pieces, and considering the associated risks are crucial for making informed investment decisions. Silver jewelry, when approached strategically, can serve as a tangible asset with potential for appreciation, adding a unique dimension to a diversified investment portfolio.

Closure

Thus, we hope this article has provided valuable insights into The Allure of Silver: Examining the Investment Potential of Silver Jewelry. We appreciate your attention to our article. See you in our next article!