The Complexities of Classifying Jewelry as a Capital Asset

Related Articles: The Complexities of Classifying Jewelry as a Capital Asset

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Complexities of Classifying Jewelry as a Capital Asset. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: The Complexities of Classifying Jewelry as a Capital Asset

- 2 Introduction

- 3 The Complexities of Classifying Jewelry as a Capital Asset

- 3.1 Defining a Capital Asset

- 3.2 Jewelry: A Multifaceted Asset

- 3.3 The Importance of Understanding Jewelry’s Classification

- 3.4 FAQs Regarding Jewelry as a Capital Asset

- 3.5 Tips for Considering Jewelry as a Capital Asset

- 3.6 Conclusion

- 4 Closure

The Complexities of Classifying Jewelry as a Capital Asset

The question of whether jewelry constitutes a capital asset is a complex one, with no definitive answer. The classification depends heavily on the specific context and the purpose for which the jewelry is held. To understand this nuance, it is crucial to examine the various factors that influence the determination of a capital asset.

Defining a Capital Asset

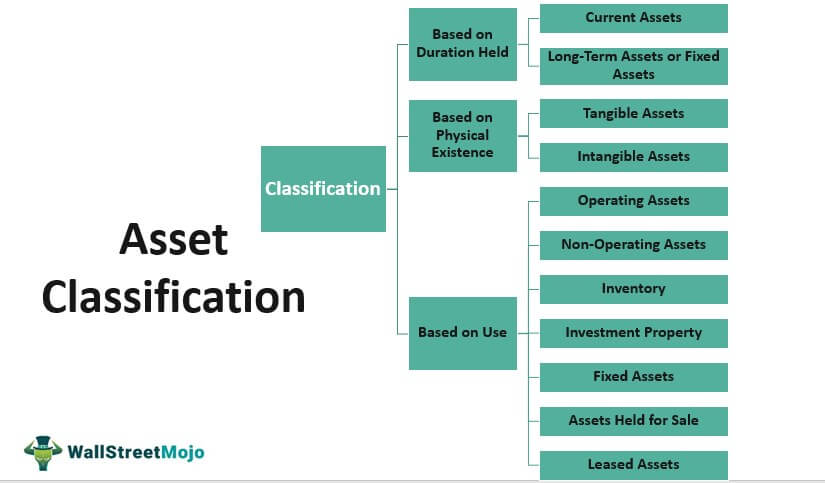

A capital asset is a tangible or intangible asset that a business or individual owns and utilizes for generating income or profit. These assets typically have a useful life extending beyond a single accounting period, and their value is expected to appreciate over time. Examples of capital assets include buildings, machinery, vehicles, and intellectual property.

Jewelry: A Multifaceted Asset

Jewelry, while undeniably a valuable possession, often straddles the line between a personal asset and a potential capital asset. The key factors that determine its classification include:

1. Intent and Purpose:

- Personal Use: Jewelry primarily intended for personal adornment or sentimental value is generally considered a personal asset. It is not acquired for generating income, and its value may fluctuate based on personal preference and market trends.

- Investment: Jewelry purchased with the explicit intention of appreciating in value over time and generating potential future income is more likely to be classified as a capital asset. This includes investments in precious metals, gemstones, or collectible pieces with established market value.

- Business Use: Jewelry used as inventory for a jewelry business or incorporated into products for sale falls under the category of business assets. These are acquired for generating revenue and are crucial for the business’s operations.

2. Nature of the Jewelry:

- Precious Metals and Gemstones: Jewelry crafted using precious metals like gold, silver, or platinum, and set with valuable gemstones, is more likely to be considered a capital asset due to its inherent value and potential for appreciation.

- Fashion Jewelry: Jewelry made from less valuable materials, often designed for current fashion trends, is typically considered a personal asset. Its value is less likely to appreciate significantly over time.

- Collectible Pieces: Antique jewelry, pieces by renowned designers, or those with historical significance can be considered capital assets due to their potential for appreciation in the collector’s market.

3. Market Value and Liquidity:

- Established Market: Jewelry with a readily available and established market value, such as gold bullion or certified diamonds, is more likely to be considered a capital asset.

- Limited Market: Jewelry with a limited market, such as custom-made pieces or unique designs, may be difficult to sell at a fair price, making its classification as a capital asset less clear.

4. Tax Implications:

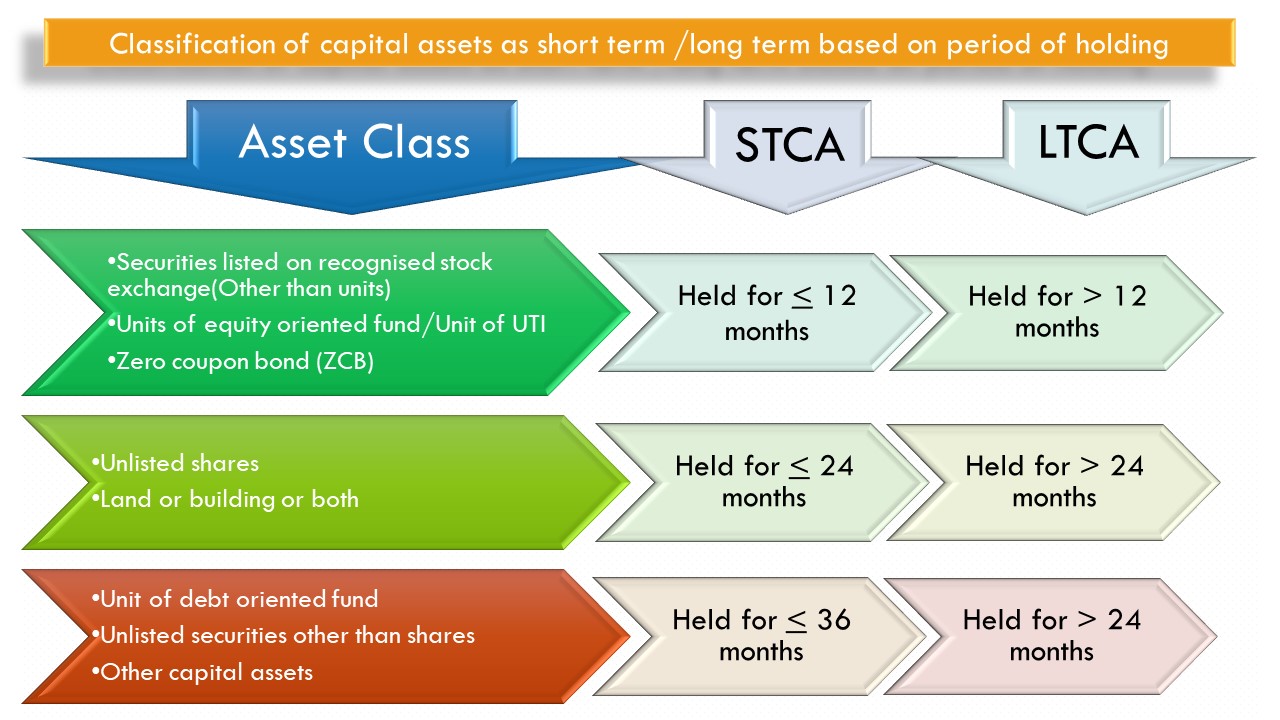

- Capital Gains Tax: When a capital asset is sold, the profit realized is subject to capital gains tax. This can vary depending on the holding period and the jurisdiction.

- Personal Assets: Personal assets are generally not subject to capital gains tax when sold. However, if the sale involves a significant profit, tax authorities may investigate the transaction to determine if it constitutes a business activity.

5. Legal and Regulatory Frameworks:

- Specific Regulations: Various countries have specific regulations regarding the classification of jewelry as a capital asset. These regulations may differ based on the type of jewelry, its intended use, and the individual’s tax status.

- Financial Reporting Standards: Financial reporting standards, such as International Financial Reporting Standards (IFRS) and US Generally Accepted Accounting Principles (GAAP), provide guidelines for classifying assets within financial statements.

The Importance of Understanding Jewelry’s Classification

The classification of jewelry as a capital asset has significant implications for:

- Taxation: Determining the tax liability on the sale or disposal of jewelry.

- Financial Reporting: Accurate reporting of assets in financial statements.

- Estate Planning: Incorporating jewelry into estate planning strategies.

- Investment Decisions: Making informed decisions about purchasing, holding, or selling jewelry for investment purposes.

FAQs Regarding Jewelry as a Capital Asset

1. Can I claim jewelry as a capital asset on my tax return?

The answer depends on the specific circumstances. If the jewelry was purchased for investment purposes and you can demonstrate its intended use for generating income, you may be able to claim it as a capital asset. However, if the jewelry is primarily for personal use, it is unlikely to be considered a capital asset for tax purposes.

2. How do I determine the market value of my jewelry for tax purposes?

Determining the market value of jewelry requires professional appraisal by a qualified gemologist or jewelry appraiser. The appraisal should be based on current market prices, considering factors such as age, condition, materials, and design.

3. Can I deduct the cost of jewelry as a business expense?

If you use jewelry as inventory for a business or incorporate it into products for sale, you may be able to deduct the cost as a business expense. However, if the jewelry is for personal use or solely for investment purposes, you cannot claim it as a business expense.

4. What are the tax implications of selling jewelry I inherited?

The tax implications of selling inherited jewelry depend on the inherited value and the sale price. You may be subject to capital gains tax on any profit realized from the sale, but there are often exemptions and deductions available.

5. How can I protect the value of my jewelry as an investment?

To protect the value of your jewelry as an investment, consider:

- Professional Appraisal: Regularly appraising your jewelry to track its value and ensure its authenticity.

- Proper Storage: Storing your jewelry in a safe and secure location to protect it from damage, theft, or loss.

- Insurance: Obtaining adequate insurance coverage to protect against loss or damage.

Tips for Considering Jewelry as a Capital Asset

- Clearly Define Intent: Before purchasing jewelry, clearly define your intended use. Are you acquiring it for personal enjoyment, investment purposes, or business use?

- Seek Professional Advice: Consult with a tax advisor, financial advisor, or legal professional to understand the implications of classifying jewelry as a capital asset.

- Maintain Documentation: Keep detailed records of all jewelry purchases, appraisals, and sales transactions. This documentation will be crucial for tax purposes and estate planning.

- Stay Informed: Stay updated on market trends, tax regulations, and legal developments that may affect the classification of jewelry as a capital asset.

Conclusion

The question of whether jewelry is a capital asset is a complex one, requiring careful consideration of various factors. While jewelry can be a valuable asset, its classification depends on the specific circumstances, including its intended use, nature, market value, and legal implications. Understanding these nuances is crucial for making informed decisions regarding taxation, financial reporting, estate planning, and investment strategies. By seeking professional advice and maintaining clear documentation, individuals can navigate the intricacies of classifying jewelry as a capital asset and ensure they are making the best decisions for their specific needs.

Closure

Thus, we hope this article has provided valuable insights into The Complexities of Classifying Jewelry as a Capital Asset. We appreciate your attention to our article. See you in our next article!