The Complexities of Insuring Timepieces: Understanding Coverage for Watches

Related Articles: The Complexities of Insuring Timepieces: Understanding Coverage for Watches

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Complexities of Insuring Timepieces: Understanding Coverage for Watches. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Complexities of Insuring Timepieces: Understanding Coverage for Watches

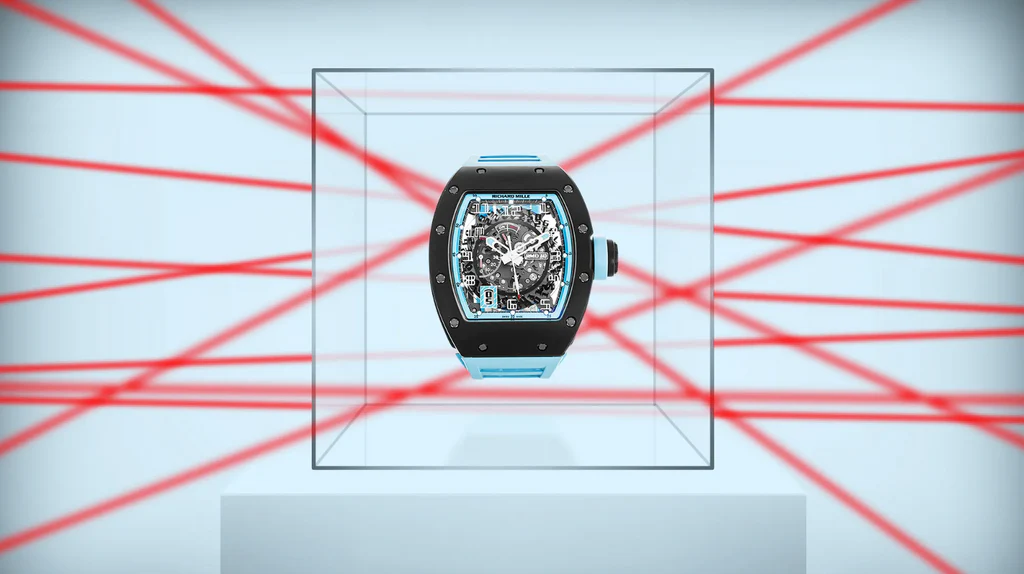

The value of a watch transcends its ability to tell time. For many, it represents a cherished heirloom, a symbol of personal style, or a substantial investment. As such, ensuring adequate insurance coverage for a valuable watch is crucial. However, the classification of a watch for insurance purposes can be a point of contention, particularly regarding its categorization as jewelry. This article explores the intricacies of watch insurance, examining the factors that influence its classification and the implications for coverage.

The Elusive Line Between Watch and Jewelry:

The distinction between a watch and jewelry for insurance purposes is not always clear-cut. While a watch inherently serves a functional purpose, its aesthetic and material value often blur the lines. This ambiguity stems from the diverse range of watch types, encompassing:

- Luxury Watches: High-end timepieces crafted with precious metals, gemstones, and intricate mechanics often command significant monetary value. These watches are frequently viewed as both functional and decorative, blurring the lines between watch and jewelry.

- Vintage Watches: Historical timepieces possess inherent value due to their age, rarity, and craftsmanship. Their historical significance and collectible nature often elevate them beyond simple timekeeping devices.

- Smartwatches: While primarily serving a functional purpose, some smartwatches utilize precious metals and materials, blurring the lines with traditional jewelry. Their technological advancements and potential for data storage add another layer of complexity to their classification.

Insurance Perspectives and Coverage Considerations:

Insurance companies typically classify watches based on their inherent value and purpose, considering factors like:

- Material: Precious metals, gemstones, and intricate craftsmanship contribute to a watch’s value and often lead to its classification as jewelry.

- Functionality: Watches primarily serving a functional purpose, such as everyday timekeeping, are less likely to be categorized as jewelry.

- Collectibility: Vintage and rare watches, often considered valuable collectibles, may be categorized as jewelry due to their historical and monetary significance.

Understanding the Impact of Watch Classification:

Classifying a watch as jewelry can significantly impact insurance coverage, particularly regarding:

- Coverage Limits: Jewelry insurance policies often have lower coverage limits compared to other types of personal property insurance.

- Deductibles: Deductibles for jewelry claims tend to be higher than those for other types of personal property.

- Exclusions: Jewelry insurance policies may have specific exclusions for certain types of damage, such as accidental damage or loss.

Navigating the Insurance Landscape:

To ensure adequate coverage for your valuable watch, consider these strategies:

- Consult with a Specialist: Seek advice from an insurance broker or agent specializing in high-value possessions. They can provide tailored recommendations based on your specific needs and the value of your watch.

- Obtain a Valuation: A professional appraisal can establish the fair market value of your watch, ensuring accurate insurance coverage.

- Compare Policies: Explore different insurance providers to compare coverage options, premiums, and deductibles.

- Consider Additional Coverage: Explore options for additional coverage, such as accidental damage, loss of use, or coverage for repairs.

- Keep Records: Maintain detailed records of your watch, including purchase receipts, appraisals, and any maintenance records.

FAQs Regarding Watch Insurance:

Q: Does my homeowner’s or renter’s insurance cover my watch?

A: Most homeowner’s and renter’s insurance policies provide limited coverage for personal property, including watches. However, the coverage limits and deductibles may not be sufficient for a valuable watch.

Q: What type of insurance policy is best for my watch?

A: A specialized jewelry insurance policy or a valuable possessions rider on your homeowner’s or renter’s insurance can provide comprehensive coverage for your watch.

Q: Do I need to insure my watch if it’s not particularly expensive?

A: While the cost of insurance may seem insignificant compared to the value of a less expensive watch, it’s crucial to consider the potential financial burden of replacing it in case of loss or damage.

Q: How often should I get my watch appraised?

A: It’s advisable to have your watch appraised every few years, especially if its value fluctuates due to market trends or changes in its condition.

Q: What happens if my watch is stolen?

A: If your watch is stolen, you should immediately report the theft to the police and your insurance company. Follow their instructions for filing a claim and provide any necessary documentation.

Tips for Protecting Your Valuable Watch:

- Safe Storage: Store your watch securely in a safe deposit box or a locked safe at home.

- Wear It Wisely: Be mindful of your surroundings when wearing your watch, especially in crowded areas or when traveling.

- Regular Maintenance: Schedule regular maintenance for your watch to ensure its optimal performance and condition.

- Keep Records: Maintain detailed records of your watch, including purchase receipts, appraisals, and any maintenance records.

Conclusion:

Ensuring adequate insurance coverage for your valuable watch is essential for safeguarding your investment. Understanding the complexities of watch classification and its implications for coverage is crucial for making informed decisions. By consulting with insurance specialists, obtaining professional valuations, and exploring various coverage options, you can secure the right protection for your treasured timepiece. Remember, your watch represents more than just time; it reflects your personal style, history, and potentially, a substantial financial investment. Proper insurance ensures that its value is safeguarded for years to come.

.png)

Closure

Thus, we hope this article has provided valuable insights into The Complexities of Insuring Timepieces: Understanding Coverage for Watches. We thank you for taking the time to read this article. See you in our next article!