The Diamond Dilemma: Is Jewelry a Wise Investment in Today’s Market?

Related Articles: The Diamond Dilemma: Is Jewelry a Wise Investment in Today’s Market?

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Diamond Dilemma: Is Jewelry a Wise Investment in Today’s Market?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Diamond Dilemma: Is Jewelry a Wise Investment in Today’s Market?

The allure of diamonds is undeniable. Their brilliance, rarity, and enduring symbolism have cemented their position as a coveted luxury for centuries. But in a world increasingly focused on financial prudence, the question arises: is buying diamond jewelry a sound investment strategy?

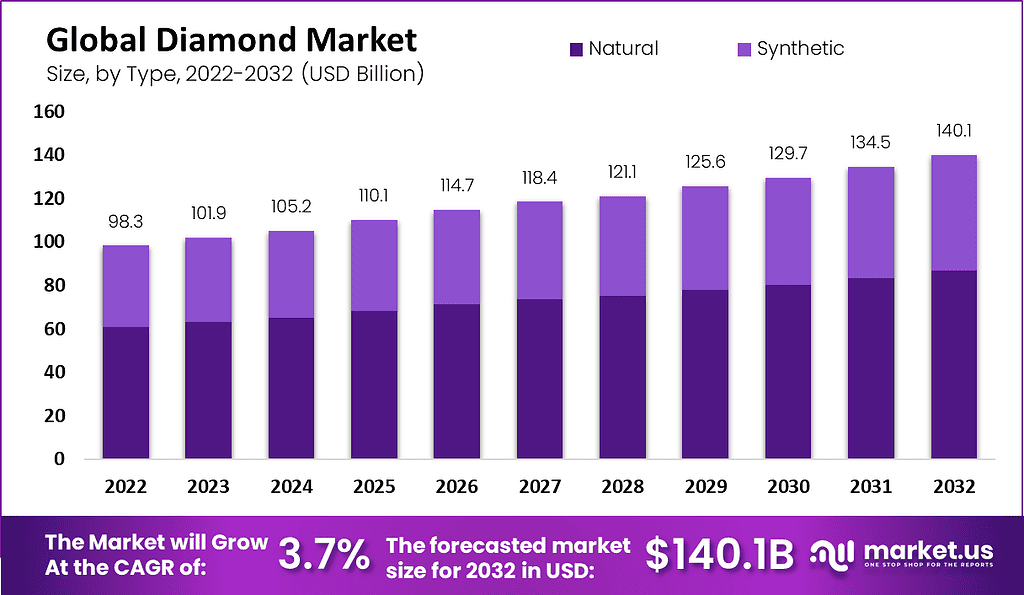

While diamonds have long been touted as a safe haven asset, akin to gold, the reality is more nuanced. The diamond market, like any other, is subject to fluctuations influenced by various factors, making it crucial to approach this decision with a clear understanding of the intricacies involved.

The Case for Diamonds:

- Historical Value: Diamonds have historically maintained their value over time, particularly for high-quality, certified stones. This resilience stems from their scarcity, limited supply, and enduring desirability.

- Emotional Value: Diamonds hold immense emotional significance, often representing love, commitment, and milestones. This intrinsic value transcends purely financial considerations, making them prized heirlooms passed down through generations.

- Liquidity: While not as liquid as stocks or bonds, diamonds can be readily resold, albeit with potential price fluctuations. This liquidity provides a level of flexibility compared to other illiquid assets.

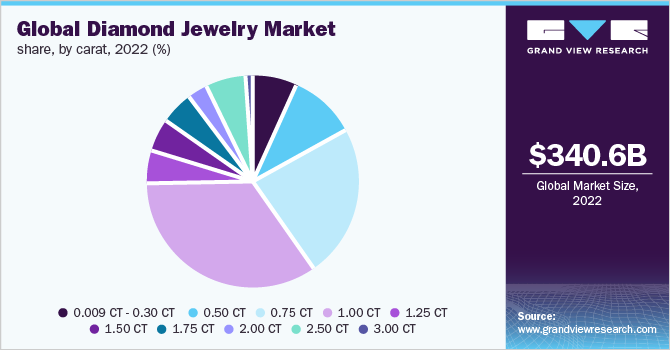

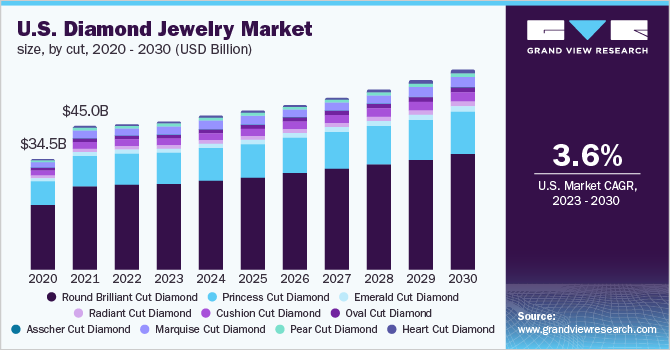

- Potential for Appreciation: As the demand for diamonds continues, particularly in emerging markets, prices can rise over time, potentially generating returns for investors.

The Challenges of Diamond Investment:

- Market Volatility: Diamond prices are susceptible to fluctuations due to economic conditions, global demand, and supply disruptions. This volatility can make it challenging to predict future price movements and achieve consistent returns.

- Lack of Transparency: The diamond market lacks the same level of transparency as traditional financial markets. Pricing can be subjective, and accurate valuation can be difficult, particularly for smaller stones or those without certification.

- High Entry Costs: Purchasing high-quality diamonds can involve significant upfront costs, making it inaccessible for many investors. Moreover, associated costs like insurance and storage add to the overall expense.

- Marketing and Sentiment: The diamond industry heavily relies on marketing and emotional appeals, which can inflate prices and create a sense of scarcity that may not be entirely justified.

Factors to Consider:

- Quality and Certification: Opting for certified diamonds from reputable sources like the Gemological Institute of America (GIA) or the American Gem Society (AGS) ensures transparency and verifiable quality.

- Cut, Color, Clarity, and Carat (4Cs): These factors significantly influence a diamond’s value. Understanding the 4Cs and their impact on price is crucial for informed decision-making.

- Investment Purpose: Clearly define your investment goals. Are you seeking long-term appreciation, a hedge against inflation, or a tangible asset with potential liquidity?

- Market Research: Stay informed about market trends, demand patterns, and economic factors that could influence diamond prices.

- Expert Advice: Consult with a reputable diamond expert or financial advisor to gain personalized insights and guidance.

FAQs about Diamond Investment:

Q: Is it better to invest in loose diamonds or diamond jewelry?

A: Loose diamonds offer greater flexibility and potential for appreciation, as they can be set into various pieces or sold independently. However, jewelry pieces can provide a more practical and readily marketable option.

Q: How can I ensure a diamond’s authenticity and value?

A: Purchase diamonds from reputable jewelers and insist on certification from reputable laboratories like GIA or AGS.

Q: What are the risks associated with diamond investment?

A: Risks include price volatility, market fluctuations, lack of transparency, and potential for fraud or misrepresentation.

Q: How can I minimize risks when investing in diamonds?

A: Conduct thorough research, purchase from reputable sources, obtain certifications, and consider expert advice.

Tips for Diamond Investment:

- Set a Budget: Determine a realistic budget and stick to it.

- Focus on Quality: Prioritize diamonds with excellent cut, color, and clarity.

- Consider Resale Value: Choose diamonds with a proven track record of holding or appreciating in value.

- Invest for the Long Term: Diamond investment is a long-term strategy, requiring patience and a commitment to holding for an extended period.

Conclusion:

The decision to invest in diamond jewelry is a personal one, influenced by individual financial goals, risk tolerance, and emotional attachment. While diamonds offer potential for appreciation and emotional value, the market is not without its complexities and risks.

A thorough understanding of the diamond market, its factors, and potential challenges is crucial before embarking on this investment journey. By prioritizing quality, seeking expert advice, and adopting a long-term perspective, individuals can navigate this market with greater confidence and potentially reap the rewards of this enduring luxury.

Closure

Thus, we hope this article has provided valuable insights into The Diamond Dilemma: Is Jewelry a Wise Investment in Today’s Market?. We appreciate your attention to our article. See you in our next article!