The Role of E-Way Bills in the Jewellery Industry: A Comprehensive Guide

Related Articles: The Role of E-Way Bills in the Jewellery Industry: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Role of E-Way Bills in the Jewellery Industry: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Role of E-Way Bills in the Jewellery Industry: A Comprehensive Guide

The Indian Goods and Services Tax (GST) regime, introduced in 2017, has significantly transformed the way businesses operate. One key aspect of this transformation is the implementation of the electronic way bill (e-way bill) system. This system, designed to monitor the movement of goods across state borders, is crucial for maintaining transparency and accountability in the supply chain. The jewellery industry, known for its high-value transactions and intricate supply chains, is directly impacted by this regulation.

Understanding the E-Way Bill System

An e-way bill is a digital document generated online, acting as a permit for the movement of goods exceeding a certain value within India. It serves as proof that the goods are being transported legally, allowing authorities to track their movement and ensure compliance with GST regulations.

Is an E-Way Bill Required for Jewellery?

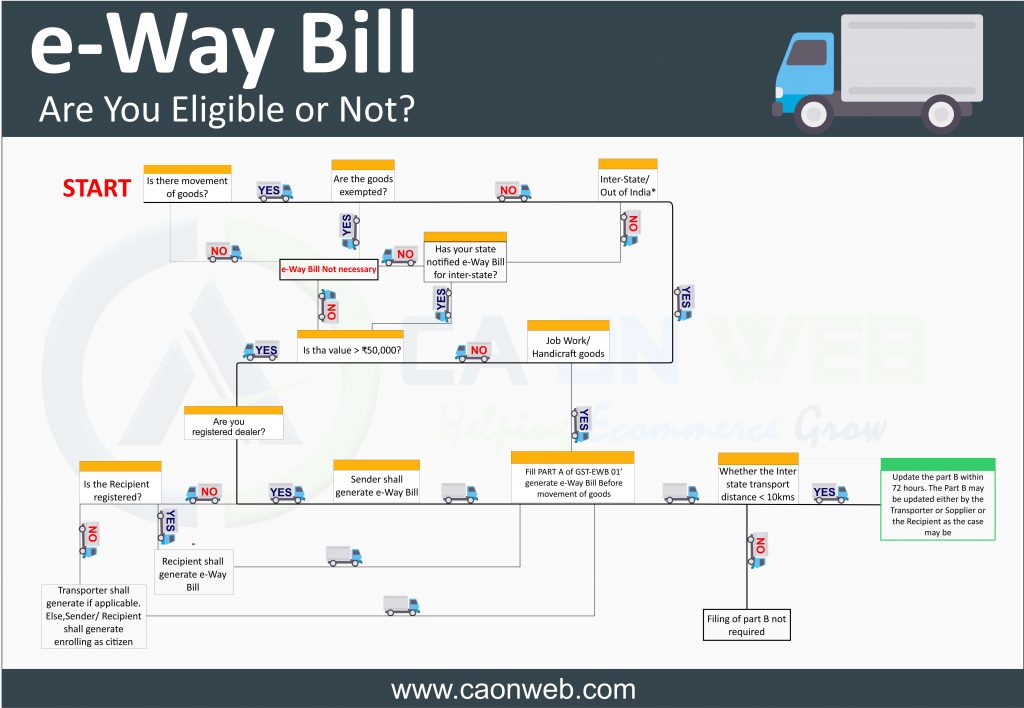

The requirement for an e-way bill for jewellery depends on the value of the goods being transported. As per the GST rules, an e-way bill is mandatory for the interstate movement of goods exceeding a threshold value of INR 50,000. This threshold applies to all types of jewellery, including gold, silver, diamonds, and other precious stones.

Benefits of Using E-Way Bills in the Jewellery Industry

The e-way bill system offers numerous benefits for businesses operating in the jewellery industry:

- Streamlined Transportation: The digital nature of e-way bills eliminates the need for physical paperwork, simplifying the process of transporting goods across state borders. This reduces administrative burden and saves time for businesses.

- Enhanced Transparency: The e-way bill system provides real-time tracking of goods in transit, offering enhanced transparency throughout the supply chain. This helps businesses monitor the movement of their inventory and identify potential delays or discrepancies.

- Improved Compliance: The e-way bill system ensures compliance with GST regulations, minimizing the risk of penalties and legal issues. This allows businesses to operate within the legal framework and maintain their reputation.

- Reduced Risk of Theft and Counterfeiting: The tracking feature of e-way bills helps in preventing theft and counterfeiting of jewellery by allowing authorities to monitor the movement of goods and identify any suspicious activities.

- Enhanced Security: The e-way bill system contributes to a more secure supply chain, reducing the risk of unauthorized access to valuable jewellery during transportation.

- Improved Inventory Management: The e-way bill system allows businesses to track the movement of their inventory, improving inventory management and reducing the risk of stockouts or overstocking.

- Data Analytics: The data generated by the e-way bill system can be used for data analytics, providing valuable insights into the movement of goods, customer behavior, and market trends. This information can be used to optimize business operations and improve decision-making.

Exemptions and Special Considerations

While the e-way bill requirement is generally applicable to the interstate movement of jewellery exceeding INR 50,000, there are some exemptions and special considerations:

- Intra-State Movement: An e-way bill is not required for the movement of goods within the same state, even if the value exceeds INR 50,000.

- Exempt Goods: Certain goods, such as jewellery used for personal use or for religious purposes, may be exempt from the e-way bill requirement. However, businesses must ensure they meet the specific criteria for exemption.

- Small-Scale Businesses: Small-scale businesses with limited turnover may be eligible for certain exemptions or simplified procedures for generating e-way bills.

- Special Economic Zones (SEZs): The e-way bill requirement may be different for goods moving within or outside SEZs. Businesses operating in SEZs should consult the relevant regulations.

FAQs

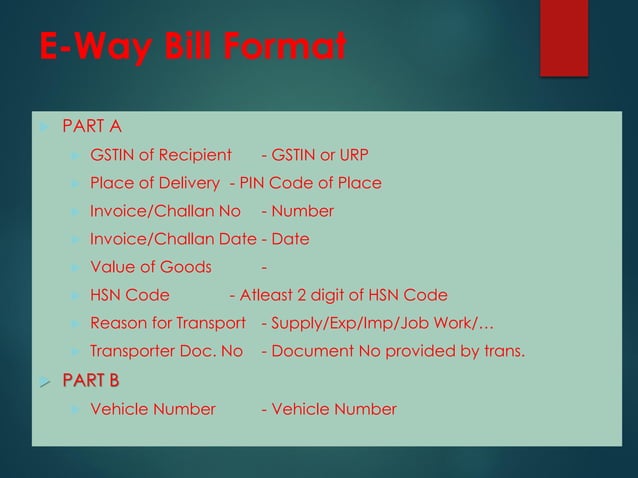

1. What is the process for generating an e-way bill for jewellery?

The process for generating an e-way bill is straightforward and can be completed online through the GST portal. Businesses need to provide information such as the GSTIN, the value of the goods, the origin and destination of the shipment, and the mode of transport.

2. What are the penalties for non-compliance with e-way bill regulations?

Failure to generate an e-way bill for the interstate movement of jewellery exceeding INR 50,000 can result in penalties ranging from INR 10,000 to INR 1 lakh, depending on the value of the goods and the nature of the violation.

3. What are the key documents required for generating an e-way bill?

The key documents required for generating an e-way bill include the GSTIN of the sender and receiver, the invoice for the goods, and the transport document (e.g., waybill, lorry receipt).

4. Can I generate an e-way bill manually?

No, e-way bills can only be generated online through the GST portal. Manual generation is not permitted.

5. What are the different types of e-way bills?

There are three types of e-way bills:

- Part A: This is generated by the supplier and contains details about the goods being transported.

- Part B: This is generated by the transporter and contains details about the transport vehicle.

- Part C: This is generated by the receiver and is used for the cancellation of the e-way bill.

6. How long is an e-way bill valid for?

The validity of an e-way bill depends on the distance of the journey and the mode of transport. For example, an e-way bill for a journey of 100 km by road is valid for 1 day, while an e-way bill for a journey of 1000 km by rail is valid for 3 days.

7. Can I generate an e-way bill retrospectively?

No, e-way bills cannot be generated retrospectively. They must be generated before the goods are transported.

8. What happens if the e-way bill is not generated on time?

If an e-way bill is not generated on time, the goods may be seized by the authorities, and the business may face penalties.

9. How can I track the status of my e-way bill?

The status of an e-way bill can be tracked online through the GST portal using the e-way bill number.

10. Who is responsible for generating the e-way bill?

The responsibility for generating an e-way bill lies with the supplier of the goods.

Tips for Effective E-Way Bill Management

- Maintain Accurate Records: Keep accurate records of all transactions involving the movement of jewellery, including invoices, transport documents, and e-way bills.

- Plan Ahead: Generate e-way bills well in advance of the transportation of goods to avoid delays.

- Use Technology: Utilize e-way bill generation and tracking software to streamline the process and minimize errors.

- Stay Updated on Regulations: Keep yourself informed about any changes or updates to the e-way bill regulations.

- Seek Professional Advice: Consult with a tax consultant or legal professional if you have any doubts or concerns about the e-way bill system.

Conclusion

The e-way bill system plays a critical role in ensuring compliance with GST regulations and streamlining the movement of goods in the jewellery industry. By embracing this system, businesses can enhance transparency, improve efficiency, and mitigate risks associated with the transportation of valuable jewellery. Compliance with e-way bill regulations is essential for maintaining a smooth and secure supply chain, ultimately contributing to the growth and success of the jewellery industry.

![]()

Closure

Thus, we hope this article has provided valuable insights into The Role of E-Way Bills in the Jewellery Industry: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!