The Strategic Significance of Gold in Investment Portfolios: A Comprehensive Analysis

Related Articles: The Strategic Significance of Gold in Investment Portfolios: A Comprehensive Analysis

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Strategic Significance of Gold in Investment Portfolios: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Strategic Significance of Gold in Investment Portfolios: A Comprehensive Analysis

Gold, a precious metal with a rich history, has long been considered a safe haven asset and a cornerstone of investment portfolios. Its unique properties, including its intrinsic value, scarcity, and historical stability, have made it a reliable hedge against inflation, economic uncertainty, and geopolitical turmoil. This article delves into the strategic significance of gold in investment portfolios, providing a comprehensive analysis of its role as a portfolio diversifier, inflation hedge, and safe haven asset.

Understanding the Intrinsic Value of Gold

Gold’s intrinsic value derives from its inherent physical properties, including its beauty, durability, and resistance to corrosion. These characteristics have led to its widespread use in jewelry, dentistry, and electronics. Unlike fiat currencies, which are subject to government intervention and inflation, gold’s value is not dependent on any external factors. It holds its worth regardless of economic fluctuations, making it a valuable asset in times of uncertainty.

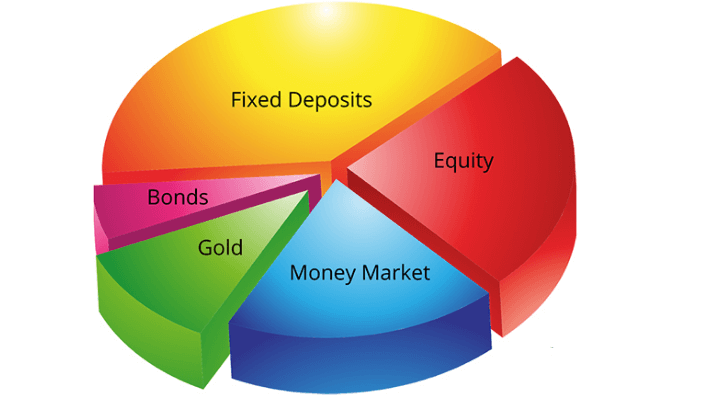

Gold as a Portfolio Diversifier

Gold’s low correlation with other asset classes, such as stocks and bonds, makes it an effective portfolio diversifier. When traditional asset classes experience downturns, gold often appreciates in value, providing a buffer against overall portfolio losses. This negative correlation stems from gold’s unique characteristics as a safe haven asset, which investors flock to during periods of economic stress.

Gold as an Inflation Hedge

Inflation erodes the purchasing power of fiat currencies, making it crucial for investors to protect their wealth. Gold has historically served as a reliable hedge against inflation, as its value tends to rise in line with increasing consumer prices. This is because gold’s scarcity and intrinsic value remain constant, while the value of fiat currencies diminishes during periods of inflation.

Gold as a Safe Haven Asset

In times of economic turmoil, investors seek safe haven assets to preserve their wealth. Gold’s reputation as a safe haven asset stems from its inherent stability and lack of dependence on external factors. During periods of geopolitical uncertainty, market volatility, or economic recession, investors tend to flock to gold, driving up its price as they seek refuge from risk.

Historical Evidence of Gold’s Performance

Throughout history, gold has demonstrated its ability to preserve wealth and provide a hedge against inflation. During periods of economic instability, such as the Great Depression and the 2008 financial crisis, gold’s value surged, outperforming traditional asset classes. This historical evidence reinforces gold’s role as a safe haven asset and its ability to protect investors’ wealth during turbulent times.

Strategic Considerations for Gold Allocation

Determining the appropriate allocation of gold in an investment portfolio requires careful consideration of individual circumstances, risk tolerance, and investment goals. Investors should consider factors such as their time horizon, financial situation, and investment strategy when deciding on their gold allocation.

Gold Investment Options

Investors can access the gold market through various investment options, including:

- Physical Gold: Investing in physical gold, such as gold bars or coins, offers direct ownership and tangible value. However, physical gold requires secure storage and may be subject to storage fees.

- Gold ETFs: Exchange-traded funds (ETFs) provide investors with a convenient and cost-effective way to gain exposure to gold. Gold ETFs track the price of gold and are traded on stock exchanges like any other security.

- Gold Mining Stocks: Investing in gold mining companies allows investors to participate in the gold market through the performance of gold producers. However, these investments carry higher risk and are subject to the performance of individual companies.

- Gold Futures: Gold futures contracts allow investors to speculate on the future price of gold. Futures contracts are highly leveraged and can amplify both gains and losses.

Conclusion

Gold’s strategic significance in investment portfolios cannot be overstated. Its role as a portfolio diversifier, inflation hedge, and safe haven asset has been proven time and again throughout history. While it’s essential to acknowledge the risks associated with any investment, gold’s unique characteristics make it a valuable asset for investors seeking to protect their wealth, diversify their portfolios, and navigate economic uncertainty. By understanding the fundamental principles of gold investment and carefully considering individual circumstances, investors can make informed decisions about their gold allocation and harness the potential benefits of this precious metal.

FAQs

Q: What are the benefits of investing in gold?

A: Investing in gold offers several potential benefits, including:

- Portfolio diversification: Gold’s low correlation with other asset classes can help reduce overall portfolio risk.

- Inflation hedge: Gold’s value tends to rise during periods of inflation, protecting investors’ purchasing power.

- Safe haven asset: During times of economic stress, investors seek gold as a safe haven, driving up its price.

- Preservation of wealth: Gold’s intrinsic value and historical stability make it a reliable way to preserve wealth.

Q: How much gold should I allocate in my portfolio?

A: The appropriate gold allocation varies depending on individual circumstances, risk tolerance, and investment goals. There is no one-size-fits-all answer. Investors should consult with a financial advisor to determine the appropriate allocation for their portfolio.

Q: What are the risks associated with investing in gold?

A: Gold investment, like any other investment, carries certain risks, including:

- Price volatility: Gold prices can fluctuate significantly, leading to potential losses.

- Storage costs: Physical gold requires secure storage, which can incur additional costs.

- Lack of income: Gold does not generate income like stocks or bonds.

Q: How can I invest in gold?

A: Investors can access the gold market through various options, including:

- Physical gold: Gold bars or coins.

- Gold ETFs: Exchange-traded funds that track the price of gold.

- Gold mining stocks: Shares of companies that extract gold.

- Gold futures: Contracts to buy or sell gold at a future date.

Q: Is gold a good investment for the long term?

A: Gold’s historical performance suggests it can be a valuable long-term investment, particularly during periods of economic uncertainty. However, investors should carefully consider their individual circumstances and investment goals before making any investment decisions.

Tips for Gold Investment

- Consider your investment goals and risk tolerance: Determine how gold fits into your overall investment strategy.

- Diversify your portfolio: Allocate a portion of your portfolio to gold to reduce overall risk.

- Choose the right investment vehicle: Select an investment option that aligns with your investment style and risk tolerance.

- Stay informed about market trends: Monitor gold prices and economic conditions to make informed investment decisions.

- Consult with a financial advisor: Seek professional guidance to create a tailored investment plan.

Conclusion

Gold’s strategic significance in investment portfolios lies in its ability to provide diversification, inflation protection, and a safe haven during turbulent times. While gold investment carries inherent risks, its historical performance and unique characteristics make it a valuable asset for investors seeking to preserve wealth and navigate economic uncertainty. By carefully considering individual circumstances, investment goals, and available investment options, investors can make informed decisions about their gold allocation and harness the potential benefits of this precious metal.

Closure

Thus, we hope this article has provided valuable insights into The Strategic Significance of Gold in Investment Portfolios: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!