Unveiling the IPO Allotment Status: A Comprehensive Guide for Investors

Related Articles: Unveiling the IPO Allotment Status: A Comprehensive Guide for Investors

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unveiling the IPO Allotment Status: A Comprehensive Guide for Investors. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unveiling the IPO Allotment Status: A Comprehensive Guide for Investors

The Initial Public Offering (IPO) process, where a private company transitions to public ownership, often sparks excitement and anticipation among investors. But before the thrill of owning shares in a new company sets in, understanding the allotment status is crucial. This article provides a comprehensive guide to the IPO allotment process, shedding light on its significance, benefits, and complexities.

Understanding the IPO Allotment Status

The IPO allotment status refers to the outcome of the application process for shares in an IPO. It signifies whether an investor has been allocated shares in the company, the number of shares allotted, and the associated details. This status is a critical piece of information for investors, as it determines their participation in the IPO and the potential financial gains.

How the Allotment Process Works

The IPO allotment process unfolds in a systematic manner:

-

Application Period: Investors submit their applications during a designated period, stating the number of shares they wish to purchase.

-

Cut-Off Date: The application period concludes on a specific date, after which no further applications are accepted.

-

Allotment Determination: The IPO issuer, with the assistance of the underwriters, determines the final allocation of shares based on factors such as:

- Demand: The number of applications received and the total number of shares applied for.

- Pricing: The IPO price set by the issuer.

- Reserved Categories: Specific allocations for retail investors, employees, or other designated groups.

- Over-subscription: If the demand for shares exceeds the available supply, an allocation process is implemented to ensure fairness and transparency.

-

Allotment Confirmation: Investors receive a confirmation of the allotment status, indicating the number of shares allocated to them and the associated details.

Significance of the Allotment Status

The IPO allotment status holds significant importance for investors:

- Participation in the IPO: It determines whether an investor will be able to participate in the IPO and own shares in the newly listed company.

- Investment Return: The number of shares allotted directly influences the potential return on investment, as the value of the shares can fluctuate after the IPO.

- Market Entry: The allotment status allows investors to gain access to the market and participate in the growth of the newly listed company.

Benefits of Understanding the Allotment Status

Understanding the IPO allotment status offers several benefits:

- Informed Decision-Making: Investors can make informed decisions about their investment strategy, knowing whether they have been allotted shares and the potential implications.

- Timely Action: Investors can take timely action based on the allotment status, such as adjusting their portfolio or exploring alternative investment opportunities.

- Transparency and Fairness: The allotment process aims to ensure transparency and fairness, minimizing the risk of manipulation or unfair allocation practices.

Factors Influencing Allotment Status

Various factors can influence the allotment status, including:

- Market Demand: High demand for the IPO can lead to over-subscription and a higher chance of partial or no allocation.

- Application Size: Larger applications may have a higher chance of allocation, but this depends on the specific IPO.

- Category: Reserved categories for retail investors or employees may have different allocation criteria.

- Application Timing: Submitting applications early may increase the chances of allocation, as some IPOs allocate shares on a first-come, first-served basis.

Navigating the Allotment Process

Investors can navigate the allotment process effectively by:

- Understanding the IPO Prospectus: The prospectus provides detailed information about the IPO, including the allocation process and the criteria used for determining allotment.

- Staying Informed: Staying updated on the IPO timeline and announcements related to the allotment process is crucial.

- Consulting Financial Advisors: Seeking guidance from financial advisors can provide valuable insights and help investors make informed decisions.

FAQs About IPO Allotment Status

1. What Happens if I Don’t Receive an Allotment?

If an investor does not receive an allotment, it means their application for shares was unsuccessful. This could be due to factors such as over-subscription or the allocation criteria not being met.

2. Can I Appeal the Allotment Decision?

Generally, the allotment decision is final and cannot be appealed. However, in rare cases, investors may have recourse if they believe there has been a procedural error or unfair allocation.

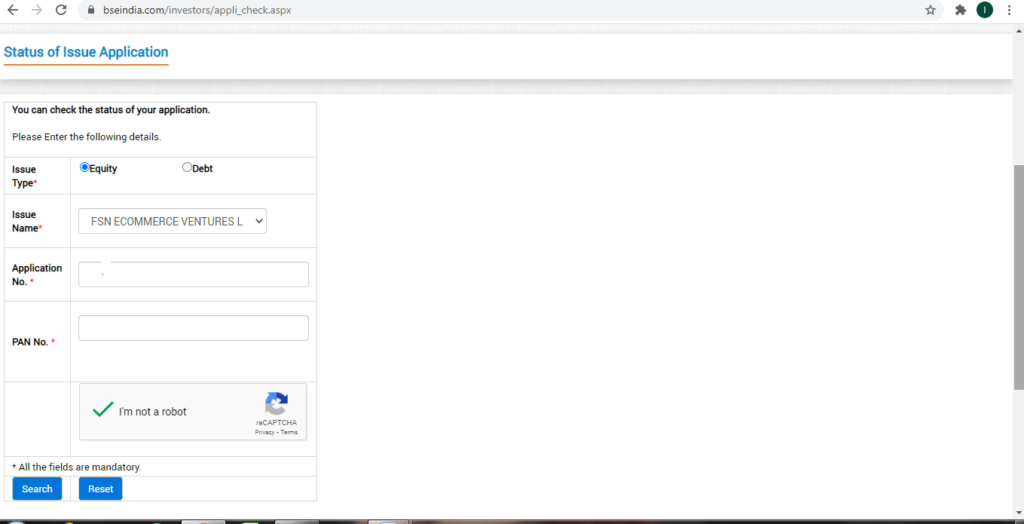

3. How Do I Know if My Allotment Status Has Been Updated?

The IPO issuer or the underwriters typically provide updates on the allotment status through official announcements, email notifications, or their website.

4. What is the Timeframe for Receiving Allotment Confirmation?

The timeframe for receiving allotment confirmation varies depending on the IPO. It can range from a few days to a few weeks after the application deadline.

5. What Happens to the Unallocated Shares?

Unallocated shares may be offered to other investors through a subsequent offer or retained by the company.

Tips for Increasing Allotment Chances

- Apply Early: Submitting applications early can increase the chances of allocation, especially for IPOs with a first-come, first-served allocation process.

- Understand the IPO Prospectus: Thoroughly review the prospectus to understand the allocation criteria and the factors influencing the allotment decision.

- Seek Financial Advice: Consulting with a financial advisor can provide valuable insights and help investors make informed decisions about their application strategy.

Conclusion

Understanding the IPO allotment status is essential for investors seeking to participate in the IPO market. By understanding the process, factors influencing allocation, and the significance of the allotment status, investors can make informed decisions and maximize their chances of success. While the allotment process can be complex, staying informed, following the guidelines, and seeking professional advice can enhance the overall investment experience.

Closure

Thus, we hope this article has provided valuable insights into Unveiling the IPO Allotment Status: A Comprehensive Guide for Investors. We hope you find this article informative and beneficial. See you in our next article!